Acetic Acid Weekly Report 01 July 2017

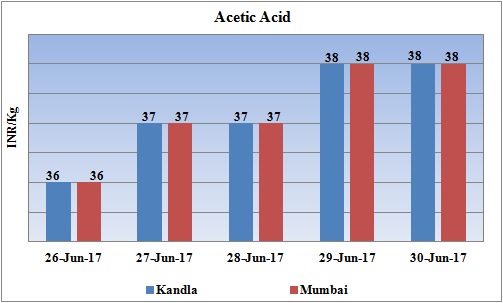

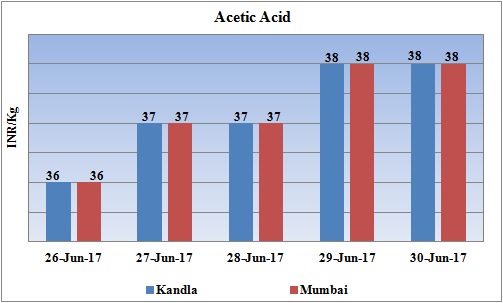

Weekly Price Trend: 26-06-2017 to 30-06-2017

- The above given graph focuses on the Acetic Acid price trend from 26th June 2017 to 30th June 2017. If we take a quick look at the above given weekly prices, it can be observed that this week there has been significant rise in domestic values.

- By end of this week, prices were assessed at the level of Rs.38/Kg for Kandla and for Mumbai port for bulk quantity.

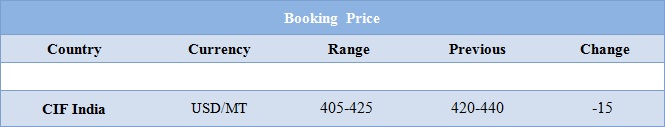

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid increased heavily for this week. There has been heavy demand with shortage in the supply of chemical. Prices were assessed at the level of Rs.38/Kg for Kandla and Mumbai port for bulk quantity.

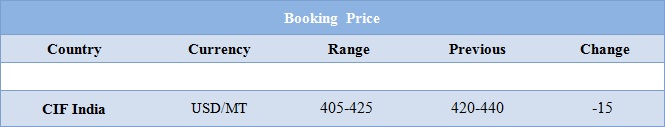

- CIF India prices of Acetic acid were assessed around USD 405-425/MTS, with a decline of USD 15/MTS in compare to last week’s closing values. The overall market trend remained volatile throughout this week with majority of chemicals witnessing slowdown in international values.

- Crude oil prices have followed positive inclination as the fall in U.S. production has bolstered markets this week.

- On Thursday, closing crude values have increased.WTI on NYME closed at $44.93/bbl, prices have increased by $0.19bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.11/bbl in compared to last trading and was assessed around $47.42/bbl.

- After the steep drop in oil prices of recent weeks, market players said that especially hedge funds saw nice buying momentum and lower U.S. crude production was the trigger to act.

- U.S. crude output dropped 100,000 barrels per day (bpd) to 9.3 million bpd last week, the steepest weekly fall since July 2016.

- As per market players recently market is cyclically bullish within a structurally bearish framework, noting that global inventories were drawing, demand is high, OPEC could still make deeper cuts and U.S. producers could be discouraged by rising costs.

- OPEC delegates have indicated they will not rush to implement further cuts to crude output. However, pressure from investors amid a relentless global supply overhang could prompt the group to consider further steps to support the market at its upcoming meeting in Russia next month.

1$ : Rs. 64.58

Import Custom Ex. Rate USD/ INR: 65.15

Export Custom Ex. Rate USD/ INR: 63.50