Acetic Acid Weekly Report 07 July 2018

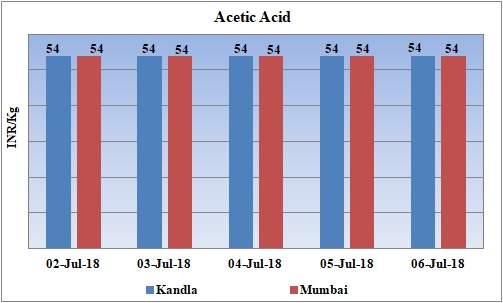

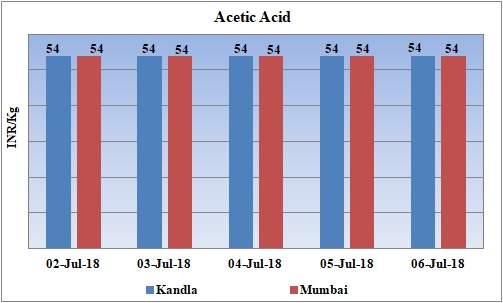

Weekly Price Trend: 02-07-2018 to 06-07-2018

- The above given graph focuses on the Acetic Acid price trend from 2nd July 2018 to 6th July 2018. If we take a quick look at the above given weekly prices, it can be observed that prices remained stable for this week.

- Domestic prices have remained soft-to-stable in the local market.

- By end of this week, prices were assessed at the level of Rs.54/Kg for Kandla and for Mumbai port for bulk quantity.

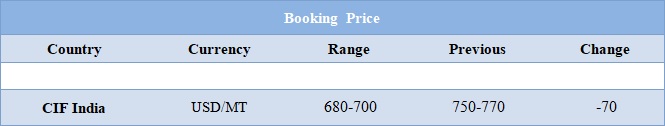

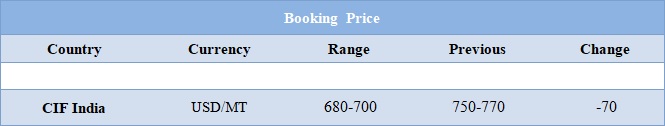

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.54/Kg for Kandla and Mumbai port of India. Prices reduced in compare to last week’s closing values.

- CFR India price were assessed around USD 680-700/MT, heavily reduced by USD 70/MT in compare to last week’s closing values.

- With restart of many Methanol units in China and Acetic Acid units, prices are now on settling mode.

- This week oil prices have followed volatile trend. On Thursday Oil fell after U.S. President Donald Trump demanded OPEC cut crude prices, but the market found some support from an Iranian threat to block shipments through the Strait of Hormuz.

- On Thursday, closing crude values have plunged. WTI on NYME closed at $72.94/bbl; prices have plunged by $1.20/bbl in compared to last closing prices. While Brent on Inter Continental Exchange plunged by $ 0.37/bbl in compare to last closing price and was assessed around $77.39/bbl.

- OPEC and Russia said in June they were willing to raise output to address concerns of supply shortages due to unplanned disruptions from Venezuela to Libya, and likely also to replace a potential fall in Iranian supplies due to U.S. sanctions. Despite these measures, Goldman Sachs said to client that "the market will remain in deficit" in the second half of the year.

- The melt down of Indian currency to its lowest level in this week will put oil prices under great pressure for India. Moreover under pressure of US, Indian government has issued to its oil companies to not to make any oil purchase from Iran will further increase the fuel prices in the country. The next week is likely to witness significant bump in fuel prices as well as petchem prices.

1$ : Rs. 68.87

Import Custom Ex. Rate USD/ INR: 69.70

Export Custom Ex. Rate USD/ INR: 68.00