Acetic Acid Weekly Report 12 May 2018

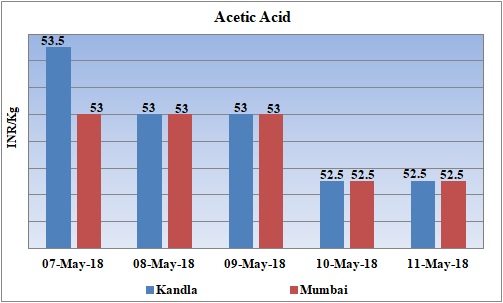

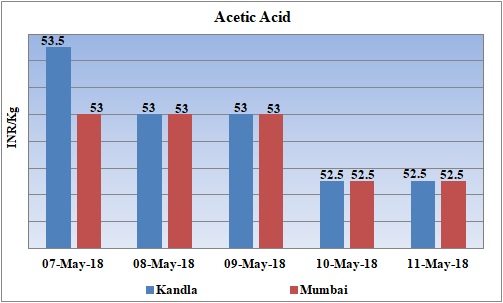

Weekly Price Trend: 07-04-2018 to 11-05-2018

- The above given graph focuses on the Acetic Acid price trend from 7th May 2018 to 11th May 2018. If we take a quick look at the above given weekly prices, it can be observed that prices has been increasing week over week.

- By end of this week, prices were assessed at the level of Rs.53.5/Kg for Kandla and Rs.54/Kg for Mumbai port for bulk quantity.

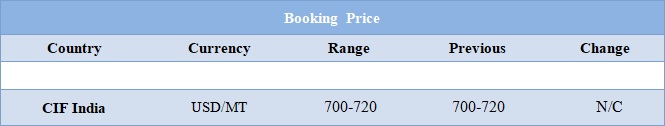

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.52.5/Kg for Kandla and for Mumbai port of India. There has been slowdown in Acetic Acid values in domestic as well international market.

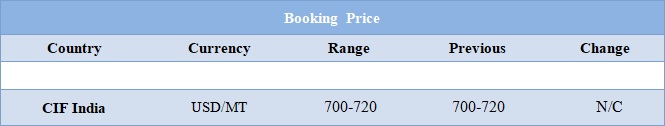

- CFR India price were assessed around USD 700-720/MT with no change in compare to last week’s closing values.

- In a major event US has decided that it will withdraw from the Iran nuclear deal and put powerful economic sanctions back into full effect. Energy-related sanctions take immediate effect for new business. But the Department of the Treasury will give businesses with existing contracts until November 4 to wind those trades down. Trump's plan to leave the Iran nuclear deal and re-impose sanctions could have major impacts for global oil, natural gas, metals and petrochemical markets.

- Many global companies have invested and have their major plans in the petrochemical industry of Iran. TOTAL, French petrochemical producer in July 2017 signed a deal with Iran's National Iranian Oil Co. to develop South Pars phase 11, which will have a production capacity of 2 Bcf/d (57 million cu m/d). Total has spent a little under $100 million on South Pars so far, according to a source close to the matter - out of a potential $2 billion price tag for phase one of the project, which also involves China's CNPC and Iranian company Petropars.

- Many experts believe that the United States will not be able to repeat the success it had last time it targeted Iran’s oil exports, when it knocked more than 1 million barrels a day out of the market. Most importantly, European and Asian countries that buy Iran’s oil aren’t enthusiastic about joining Washington in putting the squeeze on Tehran, because they see Iran as continuing to comply with the deal.

- By law, the United States must determine that the global oil market is well supplied before slapping sanctions on Iran’s oil exports — and that might be a tough argument to make with crude prices approaching four-year highs.

- This week with the little volatility oil prices have escalated sharply. On Thursday as traders adjusted to the prospects of renewed U.S. sanctions against major crude exporter Iran amid an already tightening market.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $69.06/bbl; prices have decreased by $1.67/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $1.32/bbl in compared to last trading and was assessed around $74.85/bbl.

1$ : Rs. 67.33

Import Custom Ex. Rate USD/ INR: 67.50

Export Custom Ex. Rate USD/ INR: 65.80