Acetic Acid Weekly Report 14 July 2018

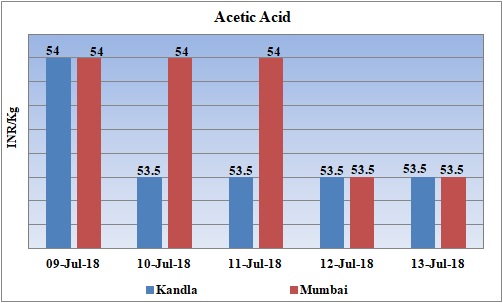

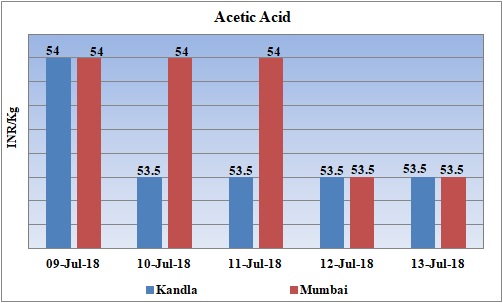

Weekly Price Trend: 09-07-2018 to 13-07-2018

- The above given graph focuses on the Acetic Acid price trend from 9th July 2018 to 13th July 2018. If we take a quick look at the above given weekly prices, it can be observed that prices remained soft-to-stable for this week.

- Domestic prices have remained soft-to-stable in the local market.

- By end of this week, prices were assessed at the level of Rs.53.5/Kg for Kandla and for Mumbai port for bulk quantity.

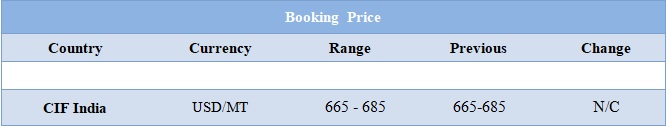

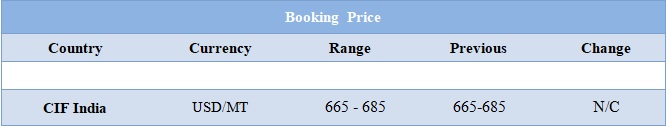

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.54/Kg for Kandla and Mumbai port of India. Prices reduced in compare to last week’s closing values.

- CFR India price were assessed around USD 665-685/MT, remained unchanged in compare to last week’s closing values.

- Prices in Indian market are likely to remain weak as there are heavy rains in Mumbai and western part of India. There is a huge impact of monsoon season on the demand for Acetic Acid which is most common used in paint and laminate industry.

- With restart of many Methanol units in China and Acetic Acid units, prices are now on settling mode.

- Prices in Indian market are likely to remain weak as there are heavy rains in Mumbai and western part of India. There is a huge impact of monsoon season on the demand for majority of petchem products.

- This week crude oil prices have followed mixed trend. On Thursday oil prices steadied, after the International Energy Agency's warned that the world's oil supply cushion "might be stretched to the limit" due to production losses in several different countries.

- Brent prices rallied on Thursday, recouping some ground following sharp losses the previous session after Libya said it would resume oil exports. Brent crude oil gained 59 cents a barrel to trade at $74/bbl. On Wednesday, the global benchmark slumped $5.46, its biggest one-day fall in two years.

- On Thursday, closing crude values have remained mixed. WTI on NYME closed at $70.33/bbl; prices have decreased by $0.05/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $1.05/bbl in compare to last closing price and was assessed around $74.45/bbl.

- As per report, inventories at the Cushing, Oklahoma, delivery hub had fallen 929,399 barrels from July 6 to July 10. Supply to the U.S. market has also been squeezed by the loss of some Canadian oil production.

- The pullback has not yet derailed the possibility that Brent will recover to above $80 a barrel by the end of the year. Market players said t hat that if Brent pulls to below $70 a barrel, there is less of a chance that the market will recover as quickly.

1$ : Rs. 68.52

Import Custom Ex. Rate USD/ INR: 69.70

Export Custom Ex. Rate USD/ INR: 68.00