Acetic Acid Weekly Report 18 Nov 2017

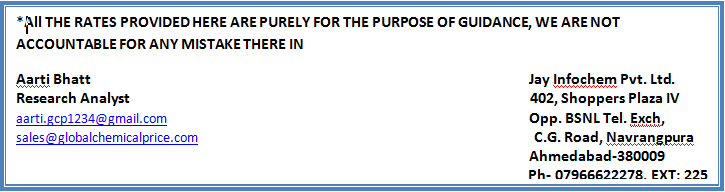

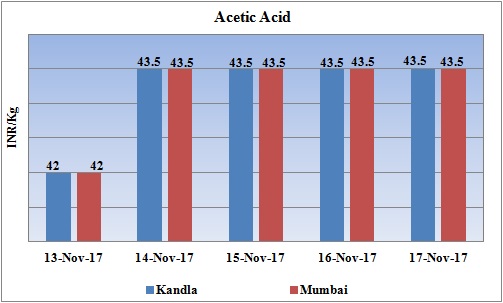

Weekly Price Trend: 13-11-2017 to 17-11-2017

- The above given graph focuses on the Acetic Acid price trend from 13th Nov 2017 to 17th Nov 2017. If we take a quick look at the above given weekly prices, it can be observed that prices again improved for this week.

- By end of this week, prices were assessed at the level of Rs.43.5/Kg for Kandla and for Mumbai port for bulk quantity.

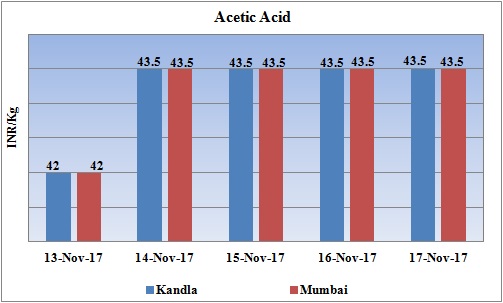

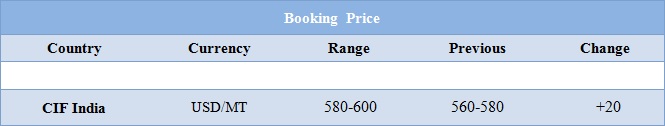

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.43.5/Kg for Kandla and Mumbai ports of India.

- Market has been at its all time high due to limited supply of the chemical. There has been noticeable variation in domestic values. With upcoming winter season there has been slowdown in supply of natural gas which in turn has led to slowdown in the production of Methanol and Acetic Acid.

- Methanol values have also increased heavily for this week. Prices were assessed at the level of CFR India 325/MTS, increased by 15/MTS in compare to last week’s closing values. On other side CFR China values were assessed around USD 363/MTS increased by USD 14/MTS in one week.

- During this winter season most of the major producers of Iran shut their unit either for maintenance or due to shortage in the supply of natural gas.

- There has been tightened supply of Acetic Acid in China market. Prices have been gaining in domestic market after long time. Inventories are now sinking in China market. Like Iran Chinese government has asked manufacturers to slowdown production using natural gas. But here the concern is of increasing pollution.

- One of the major manufacturers Celanese, is likely to restart its Acetic Acid unit by end of this week. Earlier the unit was shut down for annual maintenance program.

- Unit is based at Nanjing in China and has the production capacity of 1.2 mn tonnes/year.

- Supply will regain once this unit resume its production.

- There has been continuous hike in exchange rates for India as well. This in turn tightens the market conditions for importers.

- There has been a constant worry from China market as government over there has become really strict with petrochemical industry regarding pollution and environmental issues. Many units under shut down are unable to go on-stream due to denial from government authorities.

1$ : Rs. 67.63

Import Custom Ex. Rate USD/ INR: 66.20

Export Custom Ex. Rate USD/ INR: 64.50