Acetic Acid Weekly Report 19 May 2018

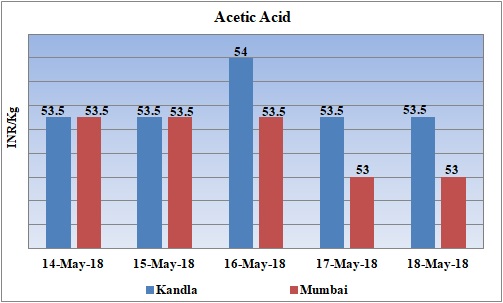

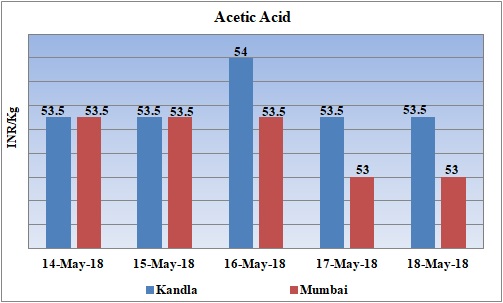

Weekly Price Trend: 14-04-2018 to 18-05-2018

- The above given graph focuses on the Acetic Acid price trend from 14th May 2018 to 18th May 2018. If we take a quick look at the above given weekly prices, it can be observed that prices has been increasing week over week.

- By end of this week, prices were assessed at the level of Rs.53.5/Kg for Kandla and Rs.54/Kg for Mumbai port for bulk quantity.

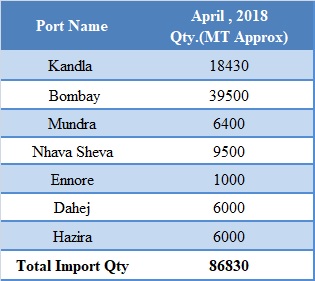

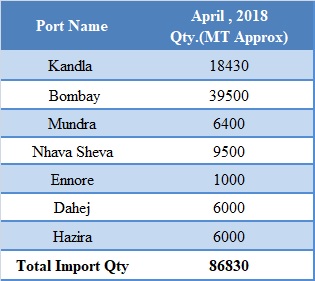

Total import at various ports in the month of April 2018

The above table depicts the various imports of Acetic Acid in the month of April 2018.

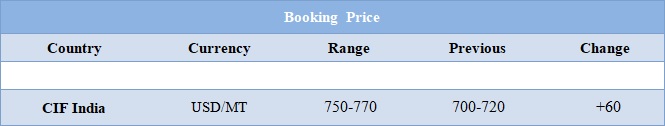

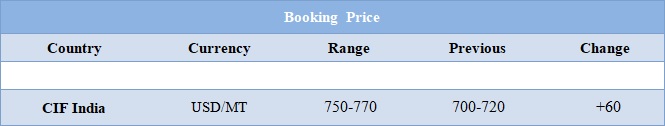

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.52.5/Kg for Kandla and for Mumbai port of India. Prices remained vulnerable throughout this week.

- CFR India price were assessed around USD 750-770/MT with n increase of USD 50/MT hange in compare to last week’s closing values.

- Fanvaran Petrochemical Company restarted its Methanol unit on Monday. Earlier the unit was shut down for annual maintenance on 21st April 2018. Unit is based at Bandar Imam Khomeini in Iran and has the manufacturing capacity of 1,000,000 mt/year.

- China based Nanjing Wilson has shut down its Methanol to Olefins (MTO) unit for annual maintenance. The unit has been shut down last week and is likely to remain off-stream for around 2-3 weeks. Unit is based at Jiangsu province of China bad has the manufacturing capacity of 295 Kt/Year.

- This week crude oil prices escalated. Oil prices hit $80 a barrel on Thursday for the first time since November 2014 on concerns that Iranian exports could fall because of renewed U.S. sanctions, reducing supply in an already tightening market.

- On Thursday, closing crude values have increased. WTI on NYME closed at $71.49/bbl; prices have increased remained firm in compared to last closing prices. While Brent on InterContinental Exchange increased by $0.02/bbl in compared to last trading and was assessed around $79.30/bbl.

- As per market report, The potential loss of 1 million barrels of Iranian crude from the world market and the ongoing decline of Venezuela's oil sector could push oil prices beyond $100/b. Global inventories of crude oil and refined products dropped sharply in recent months owing to robust demand and OPEC-led production cuts.

- Several banks have in recent days raised their oil price forecasts, citing tighter supplies and strong demand. Shell said it was halting crude exports from a major Nigerian pipeline.

- French petrochemical firm Total said that it may pull out all its investments from Iran where again sanctions has been imposed by US unless the sanctions relief is provided to the firm.

- Total has invested in Iran in South Pars along with Chinese firm CNPC and Iranian firm Petropars. Total itself holds 50.1% stake in South Pars Phase 11 with China’s state-owned CNPC owning 30% and Iran's Petropars 19.9%.

1$ : Rs. 68.00

Import Custom Ex. Rate USD/ INR: 68.65

Export Custom Ex. Rate USD/ INR: 66.95