Acetic Acid Weekly Report 21 July 2018

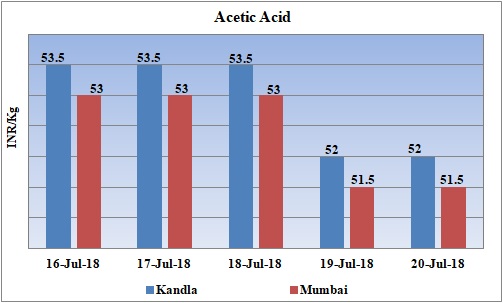

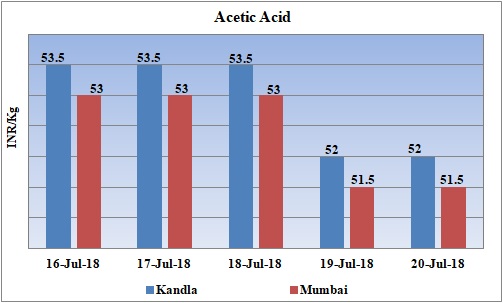

Weekly Price Trend: 16-07-2018 to 20-07-2018

- The above given graph focuses on the Acetic Acid price trend from 16th July 2018 to 20th July 2018. If we take a quick look at the above given weekly prices, it can be observed that prices remained soft-to-stable for this week.

- Domestic prices have remained soft-to-stable in the local market.

- By end of this week, prices were assessed at the level of Rs.52/Kg for Kandla and Rs.51.5/Kg for Mumbai port for bulk quantity.

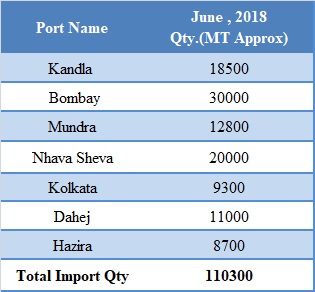

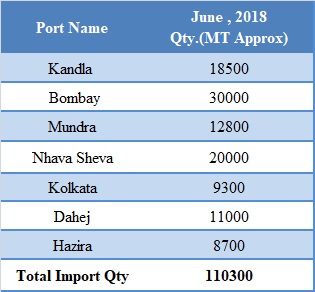

Total import at various ports in the month of June 2018

The above table depicts the various imports of Acetic Acid in the month of June 2018.

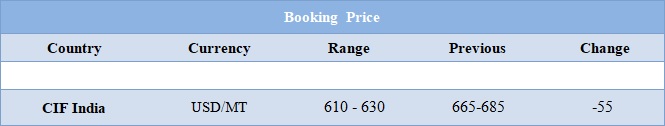

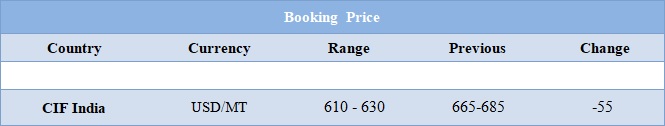

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices of Acetic acid assessed around Rs.52.5/Kg for Kandla and Rs.51/Kg for Mumbai port of India. Prices reduced in compare to last week’s closing values.

- CFR India price were assessed around USD 610-630/MT, reduced by USD 55/MT in compare to last week’s closing values.

- Prices in Indian market are likely to remain weak as there are heavy rains in Mumbai and western part of India. There is a huge impact of monsoon season on the demand for Acetic Acid which is most common used in paint and laminate industry.

- With restart of many Methanol units in China and Acetic Acid units, prices are now on settling mode.

- Prices in Indian market are likely to remain weak as there are heavy rains in Mumbai and western part of India. There is a huge impact of monsoon season on the demand for majority of petchem products.

- This week oil prices have followed mixed trend. On Thursday, Brent crude fell as concerns about mounting supply returned after a brief rally on comments that Saudi Arabia's exports would fall in August. Crude also strengthened on forecasts that inventories at the U.S. oil delivery hub for WTI in Cushing, Oklahoma fell 1.8 million barrels, or 6.2 percent.

- On Thursday, closing crude values have remained mixed. WTI on NYME closed at $69.46/bbl; prices have increased by $0.70/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.32/bbl in compare to last closing price and was assessed around $72.58/bbl.

- As per report, Saudi Arabia expects its crude exports to drop by roughly 100,000 bpd in August as the kingdom limits excess production.

- As per report, Saudi Arabia's crude oil exports in July would be roughly equal to June levels. Despite international oil markets being well balanced in the third quarter, there would still be substantial stock draws due to robust demand.

1$ : Rs. 68.87

Import Custom Ex. Rate USD/ INR: 69.60

Export Custom Ex. Rate USD/ INR: 67.90