ACN Weekly Report 07 July 2018

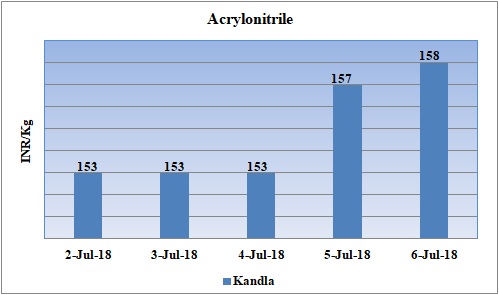

Weekly Price Trend: 02-07-2018 to 06-07-2018

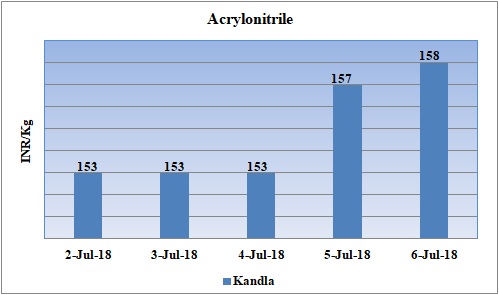

- The above given graph focuses on the ACN price trend from 2nd July to 6th July 2018.

- Domestic prices increased significantly for this week. Prices were assessed around Rs.158/Kg for bulk quantity by end of the week for Kandla port.

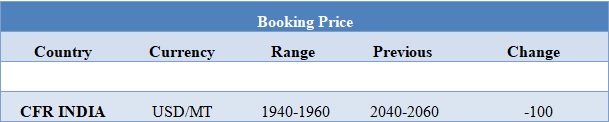

Booking Scenario

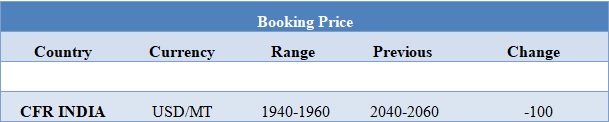

The above chart shows the international prices of ACN. CFR India prices of ACN were assessed in the range of USD 1940-1960/MT.

INDIA& INTERNATIONAL

- Prices of ACN were assessed around Rs.158/kg, increased by Rs.5 in this week. This hike has been in particular due to delay in shipments and short supply of the chemical.

- CFR India prices of Acrylonitrile were assessed in the range of USD 1040-1060/MT, reduced by USD 100/MT in compare to last week’s closing values.

- Feedstock Propylene market reduced for this week. FOB Korea values were assessed around USD 1055/MT while CFR China values were assessed around USD 1065/MT while CFR SEA values assessed around USD 990/MT.

- Moreover monsoon has started in India. The western part of India is receiving heavy rainfall which in turn has led to slowdown in imports along with limited supply.

- In monsoon season the end consumer prefers limited material as most of the work gets affected due to heavy rainfall and stocking issue and other limited supply from importer.

- This week oil prices have followed volatile trend. On Thursday Oil fell after U.S. President Donald Trump demanded OPEC cut crude prices, but the market found some support from an Iranian threat to block shipments through the Strait of Hormuz.

- On Thursday, closing crude values have plunged. WTI on NYME closed at $72.94/bbl; prices have plunged by $1.20/bbl in compared to last closing prices. While Brent on Inter Continental Exchange plunged by $ 0.37/bbl in compare to last closing price and was assessed around $77.39/bbl.

- OPEC and Russia said in June they were willing to raise output to address concerns of supply shortages due to unplanned disruptions from Venezuela to Libya, and likely also to replace a potential fall in Iranian supplies due to U.S. sanctions. Despite these measures, Goldman Sachs said to client that "the market will remain in deficit" in the second half of the year.

$1 = Rs. 68.87

Import Custom Ex. Rate USD/ INR: 69.70

Export Custom Ex. Rate USD/ INR: 68.00