ACN Weekly Report 08 Sep 2018

Weekly Price Trend: 03 -09-2018 to 07-09-2018

- The above given graph focuses on the ACN price trend from 3rd Sept to 7th Sept 2018.

- Domestic prices remained volatile for this week. Prices were assessed around Rs.175/Kg for bulk quantity by end of the week for Kandla port. There has been vulnerability in domestic prices for ACN.

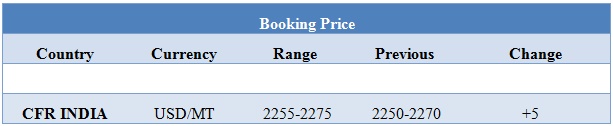

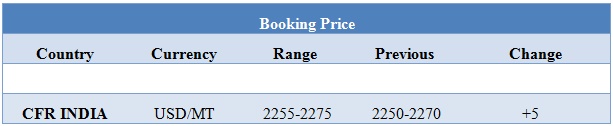

Booking Scenario

The above chart shows the international prices of ACN. CFR India prices of ACN were assessed in the range of USD 2255-2275/MT.

INDIA& INTERNATIONAL

- Prices of ACN were assessed around Rs.175/kg, remained volatile throughout this week. Prices reduced by Rs.1/Kg for this week.

- CFR India prices of Acrylonitrile were assessed in the range of USD 2255-2275/MT, slightly increased by USD 5/MT for this week.

- There has been continuous soaring in crude prices in this week. The US inventories have fell to their lowest levels since February 2015. US West Texas Intermediate (WTI) crude futures were at $67.90 per barrel at 0056 GMT, up 13 cents, or 0.2 per cent, from their last settlement. International Brent crude futures climbed 12 cents, or 0.2 per cent, to $76.62 a barrel. With release of Oil inventory data last night, a large number has been drawn from crude inventories.

- Global oil markets have tightened over the last month, pushing up Brent prices by more than 10 per cent since the middle of August. Investors anticipate less supply from Iran as US sanctions on Tehran begin to bite.

- With ship-tracking data now pointing at a reduction in Iranian exports, renewed strife in Libya, and Venezuelan export availability hobbled by an accident at the key Jose terminal, the list of bullish headlines is getting longer,” said Michael Dei-Michei, head of research at Vienna consultancy JBC Energy.

- US is quite actively tracking the flow of crude and has managed to use its sanctions very actively against Iran. They are forcing many western companies to cease export from Iran and avoid trading with them.

- Contrary to this India and China are making efforts to continue their imports from using one or other way. Global oil markets have tightened over the last month, pushing up Brent prices by more than 10 per cent since the middle of August. Investors anticipate less supply from Iran as US sanctions on Tehran begin to bite.

$1 = Rs. 71.73

Import Custom Ex. Rate USD/ INR: 71.10

Export Custom Ex. Rate USD/ INR: 69.40