ACN Weekly Report 16 Sep 2017

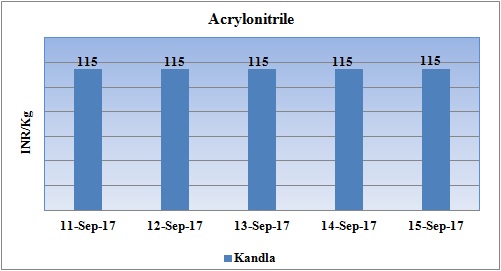

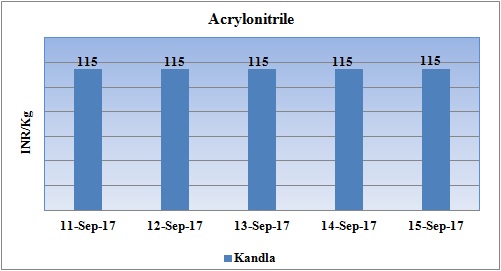

Weekly Price Trend: 11-09-2017 to 15-09-2017

- The above given graph focuses on the ACN price trend from11th September to 15th September 2017. In compare to last week’s closing values there has been no change in domestic values.

- Domestic prices were assessed at the level of Rs.115/Kg, with no change in compare to last week’s closing values.

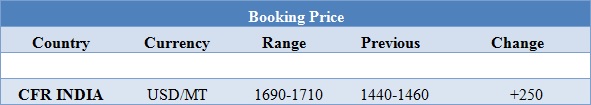

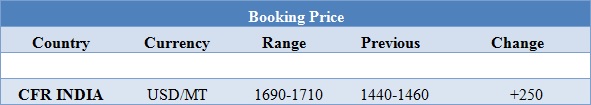

Booking Scenario

The above chart shows the international prices of ACN. CFR India prices of ACN were assessed in the range of USD 1440-1460/MT.

INDIA& INTERNATIONAL

- Domestic prices of ACN remained stable for this week. Prices were assessed at the level of Rs 115/Kg for bulk quantity.

- CFR India prices of Acrylonitrile were assessed in the range of USD 1690-1710/MT, increased by USD 250/MTS in compare to last week’s closing values.

- There has been significant rise in Asian contract price for ACN in Asian markets. The hike has been in particular due to gain in the values of upstream Propylene prices in Asian market. CFR South East Asia prices were assessed around USD 1640/MT, gain of USD 70/MT. CFR Far East Asia prices were assessed around USD 1675/MT and increase of USD 70/MT in a week.

- This hike has been particularly due to adverse effect of hurricane Harvey. One of the major plant of ACN i.e. Ineos continue its force majeure in Texas.

- According to trader the Asian countries are really facing extreme tight supply of ACN. In China many domestic units of ACN has been shut down due to environmental issues and environment protection act. Hike in values will continue to dominate for at least few more weeks.

- Many of the China based units like Sinopec Qilu having capacity of 80,000 mt/year and Jilin having the capacity of no1 unit 1,106,000 mt/year were shut down in mid of this year. Restart of these units continues to remain uncertain.

- On other side feedstock propylene prices were assessed around USD 1005/mt CFR China levels, a steep hike of week on week rise of USD 60/mt. FOB Korea values for Propylene were assessed around USD 945/MT, hike of USD 50/MT in one week. CFR SEA prices were assessed around USD 875/MT, steep hike of USD 90/MT.

- This week has been highly positive for crude values in international market. On Thursday closing, crude values gained in the international market.WTI on NYME closed at $49.89/bbl, prices improved by 0.59 in compared to last closing prices. While, Brent on Inter Continental Exchange was assessed at the rate of $55.47/bbl increased by 0.31/bbl on Wednesday.

$1 = Rs. 64.07

Import Custom Ex. Rate USD/ INR: 64.90

Export Custom Ex. Rate USD/ INR: 63.25