ACN Weekly Report 19 May 2018

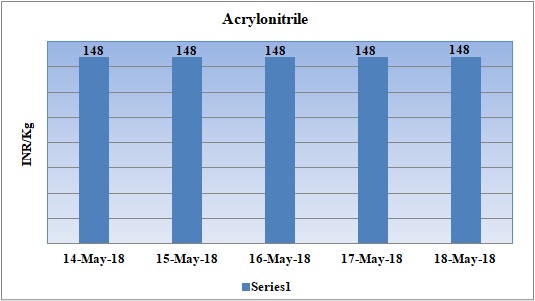

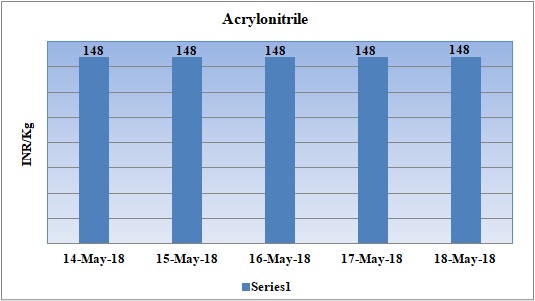

Weekly Price Trend: 14-05-2018 to 18-05-2018

- The above given graph focuses on the ACN price trend from 14th May to 18th May 2018.

- Domestic prices reduced for this week. Prices were assessed around Rs.148/Kg for bulk quantity by end of the week for Kandla port.

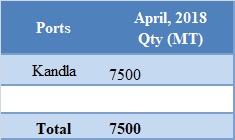

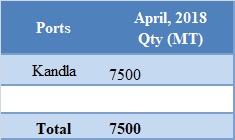

Total ACN import in the month of April 2018

The above table depicts the import of ACN at Kandla port in the month of April 2018.

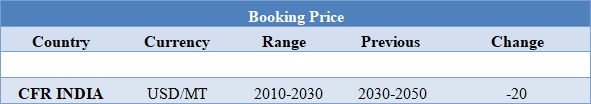

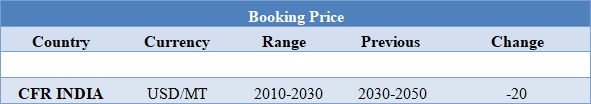

Booking Scenario

The above chart shows the international prices of ACN. CFR India prices of ACN were assessed in the range of USD 2010-2030/MT.

INDIA& INTERNATIONAL

- Prices of ACN were assessed around Rs.148Kg, reduced by Rs.4/Kg in this week. The weakened supply in international market has led to hike in domestic values.

- CFR India prices of Acrylonitrile were assessed in the range of USD 2010-2030/MT, reduced by reduced by USD 20/MT in compare to last week’s closing values.

- Feedstock Propylene market increased for this week. FOB Korea values were assessed around USD 1075/MT while CFR China values were assessed around USD 1105/MT while CFR SEA values assessed around USD 985/MT.

- This week crude oil prices escalated. Oil prices hit $80 a barrel on Thursday for the first time since November 2014 on concerns that Iranian exports could fall because of renewed U.S. sanctions, reducing supply in an already tightening market.

- On Thursday, closing crude values have increased. WTI on NYME closed at $71.49/bbl; prices have increased remained firm in compared to last closing prices. While Brent on InterContinental Exchange increased by $0.02/bbl in compared to last trading and was assessed around $79.30/bbl.

- As per market report, The potential loss of 1 million barrels of Iranian crude from the world market and the ongoing decline of Venezuela's oil sector could push oil prices beyond $100/b. Global inventories of crude oil and refined products dropped sharply in recent months owing to robust demand and OPEC-led production cuts.

- Several banks have in recent days raised their oil price forecasts, citing tighter supplies and strong demand. Shell said it was halting crude exports from a major Nigerian pipeline.

- French petrochemical firm Total said that it may pull out all its investments from Iran where again sanctions has been imposed by US unless the sanctions relief is provided to the firm.

- Total has invested in Iran in South Pars along with Chinese firm CNPC and Iranian firm Petropars. Total itself holds 50.1% stake in South Pars Phase 11 with China’s state-owned CNPC owning 30% and Iran's Petropars 19.9%.

$1 = Rs. 68.00

Import Custom Ex. Rate USD/ INR: 68.65

Export Custom Ex. Rate USD/ INR: 66.95