ACN Weekly Report 21 July 2018

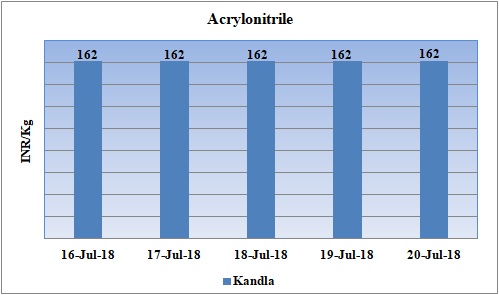

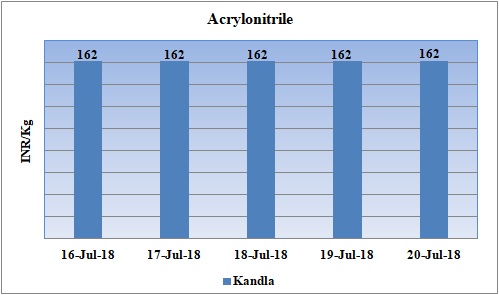

Weekly Price Trend: 16-07-2018 to 20-07-2018

- The above given graph focuses on the ACN price trend from 16th July to 20th July 2018.

- Domestic prices increased significantly for this week. Prices were assessed around Rs.164/Kg for bulk quantity by end of the week for Kandla port. There has been an increase of 6% in the domestic prices in one week.

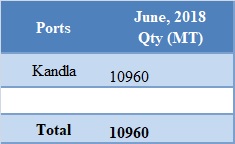

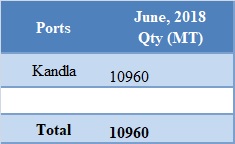

Total ACN import in the month of June 2018

The above table depicts the import of ACN at Kandla port in the month of June 2018.

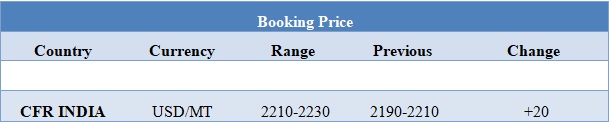

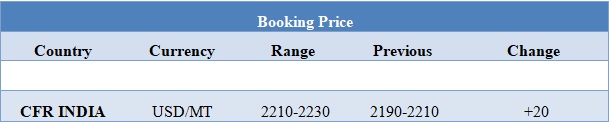

Booking Scenario

The above chart shows the international prices of ACN. CFR India prices of ACN were assessed in the range of USD 2190-2210/MT.

INDIA& INTERNATIONAL

- Prices of ACN were assessed around Rs.162/kg, slightly reduced by Rs.2/Kg for this week.

- CFR India prices of Acrylonitrile were assessed in the range of USD 2210-2230/MT, increased by USD 20/MT in compare to last week’s closing values.

- At present the prices for ACN are at its peak in last more than five years. The sole reason for this hike has been the limited supply of the chemical across the globe.

- The other major reason is that many of the major ACN manufacturing units has scheduled their maintenance in next few months. Costing factor no more depends on feedstock values only follows the supply trend.

- Many ACN units will undergo maintenance. Some of are listed below.

- ACN unit will be shut down by Shanghai SECCO for annual maintenance turnaround by end of September The unit is likely to remain off-stream for around two months and will resume its production by November end.

- The unit is based at Shanghai in China and has the manufacturing capacity of 5,20,000 mt/year.

- ACN unit will be shut down by Jiangsu Sailboat Petrochemical for maintenance turnaround by end of this week The unit is likely to remain off-stream for around one month and will resume its production by August end. The unit is based at Lianyungang in China and has the manufacturing capacity of 2,60,000 mt/year.

- The leading petrochemical manufacturer Formosa Plastics has announced its maintenance schedule for the ACN unit. The unit is likely to go off-stream in the last week of August and is likely to remain off-stream for around 45 days. Unit may resume its production in the second week of September.

- Unit is based at Mailiao n Taiwan and has the manufacturing capacity of 2,80,00 tonnes/year.

- Sumitomo Chemical will shut down its ACN unit in the month of September. The unit is beads at Nihama in Japan and has the manufacturing capacity of 70,000 tonnes/year.

- New units are likely to start their production in this year which will help in the tightened supply of ACN.

- Feedstock Propylene market reduced for this week. FOB Korea values were assessed around USD 1045/MT while CFR China values were assessed around USD 1070/MT while CFR SEA values assessed around USD 965/MT.

- This week oil prices have followed mixed trend. On Thursday, Brent crude fell as concerns about mounting supply returned after a brief rally on comments that Saudi Arabia's exports would fall in August. Crude also strengthened on forecasts that inventories at the U.S. oil delivery hub for WTI in Cushing, Oklahoma fell 1.8 million barrels, or 6.2 percent.

- On Thursday, closing crude values have remained mixed. WTI on NYME closed at $69.46/bbl; prices have increased by $0.70/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.32/bbl in compare to last closing price and was assessed around $72.58/bbl.

$1 = Rs. 68.87

Import Custom Ex. Rate USD/ INR: 69.60

Export Custom Ex. Rate USD/ INR: 67.90