ACN Weekly Report 24 Feb 2018

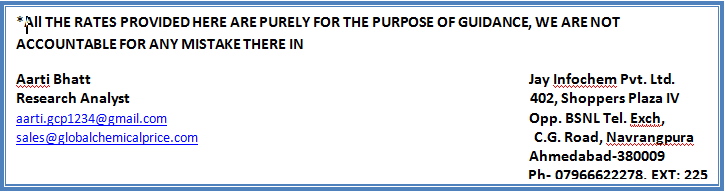

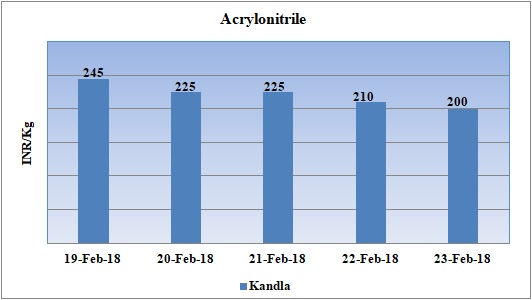

Weekly Price Trend: 19-02-2018 to 23-02-2018

- The above given graph focuses on the ACN price trend from 19th Feb to 23rd Feb 2018.

- After weeks of hike. Now prices are regaining the composure. The incredible rise in last few weeks has been due to supply of chemical in domestic market. This has now become stable as prices are settling down.

- Prices reduced by Rs.45/Kg in one week. The closing value for ACN for this week was Rs.200/Kg for Kandla port.

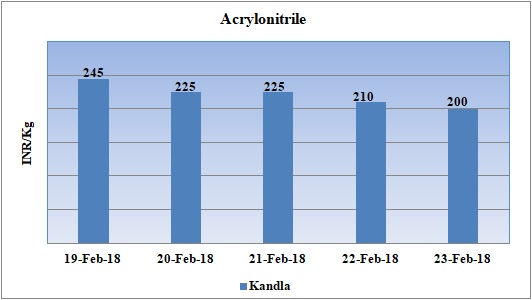

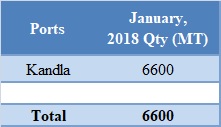

Total import at various ports in the month of January 2018

The above chart depicts the import of ACN at Kandla port of India in the month of January 2018.

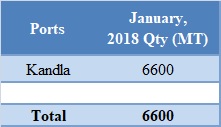

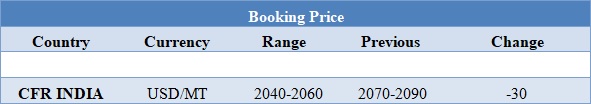

Booking Scenario

The above chart shows the international prices of ACN. CFR India prices of ACN were assessed in the range of USD 2040-2060/MT.

INDIA& INTERNATIONAL

- After an unprecedented hike in values in last few months the domestic values has now reduced for this week. Prices of ACN were assessed around Rs.200/Kg, decreased by Rs.45/Kg for bulk quantity in span of one week.

- CFR India prices of Acrylonitrile were assessed in the range of USD 2040-2060/MT, decreased by USD 30/MTS in compare to last week’s closing values.

- Feedstock Propylene market has also remained stable for this week. FOB Korea values were assessed around USD 1055/MT while CFR China values were assessed around USD 1110MT.

- China market remained closed due to Lunar holidays. The activities will resume in full fledge way next week.

- South Korea based Taekwang Industrial has shut down its ACN unit for maintenance turnaround. The unit has been shut down for maintenance schedule. Unit is based at Uslan in South Korea and has the production capacity of 2,90,000 mt/year.

- This week oil prices have followed mixed trend. Oil prices rose on Thursday, on U.S. crude stocks unexpectedly declined and also by a drop in the dollar.

- On Thursday, closing crude values have increased. WTI on NYME closed at $62.77/bbl; prices have increased by $1.09/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.97/bbl in compared to last trading and was assessed around $66.39/bbl.

- Crude inventories had been forecast to rise 1.8 million barrels, as stocks seasonally increase when refineries cut intake to conduct maintenance. As per source, the unexpected fall in oil inventories in the U.S. should see support for crude oil prices remain strong.

$1 = Rs. 64.73

Import Custom Ex. Rate USD/ INR: 64.40

Export Custom Ex. Rate USD/ INR: 62.85