ACN Weekly Report 26 Aug 2017

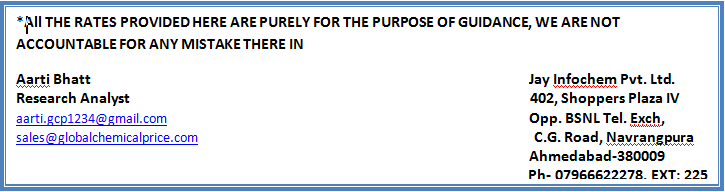

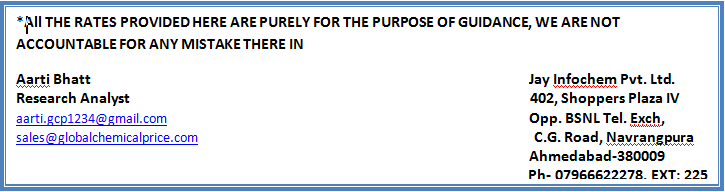

Weekly Price Trend: 21-08-2017 to 25-08-2017

- The above given graph focuses on the ACN price trend from 21st August to 25th Aug 2017. In compare to last week’s closing values there has been slight change in domestic values.

- Domestic prices were assessed at the level of Rs.105/Kg, slightly increased in compare to last week’s closing values.

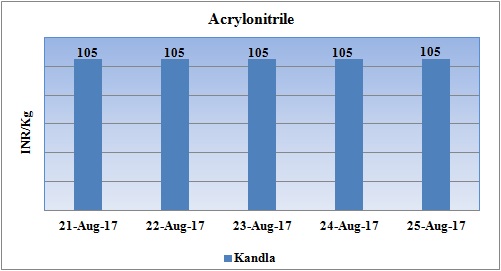

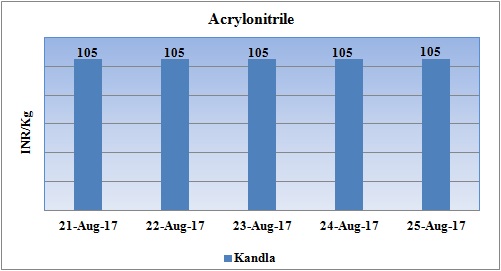

Total import at Kandla port in the month of July 2017

The above chart depicts the import of ACN at Kandla port of India in the month of July 2017.

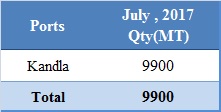

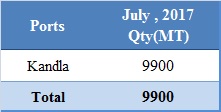

Booking Scenario

The above chart shows the international prices of ACN. CFR India prices of ACN were assessed in the range of USD 1370-1390/MT.

INDIA& INTERNATIONAL

- Domestic prices of ACN decreased slightly for this week. Prices were assessed at the level of Rs 105/Kg for bulk quantity.

- CFR India prices of Acrylonitrile were assessed in the range of USD 1370-1390/MT, remained unchanged in compare to last week’s closing values.

- Due to ongoing monsoon season demand for ACN also reduced in domestic consumption. Now with starting of festive season across the nation requirement for paints and coatings will increase will in turn boost up the demand for this chemical.

- This week crude oil prices have remained volatile. On Friday, oil prices rose as the U.S. petroleum industry prepared for potential output disruptions as Hurricane Harvey headed for the heart of the nation’s oil industry in the Gulf of Mexico. The storm has rapidly intensified since Thursday while On Thursday closing crude values have decreased.WTI on NYME closed at $47.43/bbl, prices have decreased by $0.98/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.53/bbl in compared to last trading and was assessed around $52.04/bbl.

- As per report, Prices rose as production in the affected area shut down in preparation for the hurricane, and on expectations that closures could last if the storm causes extensive damage.

- Market players have said that traders expect more upward pressure as the storm gets closer to Texas. Oil prices, however, fell because refiners may use less supply due to the storm.

- It is anticipated that recently oil prices to trade higher on account of support coming from inventory withdrawals in the US. However, Libya’s rising output remains a cause of concern for oil markets.

$1 = Rs. 64.03

Import Custom Ex. Rate USD/ INR: 65.15

Export Custom Ex. Rate USD/ INR: 63.45