ACN Weekly Report 28 April 2018

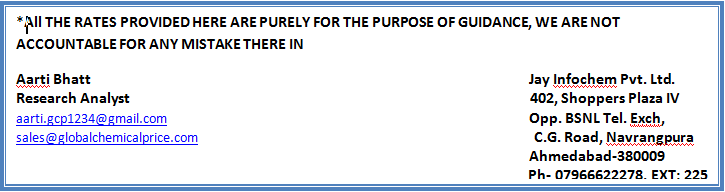

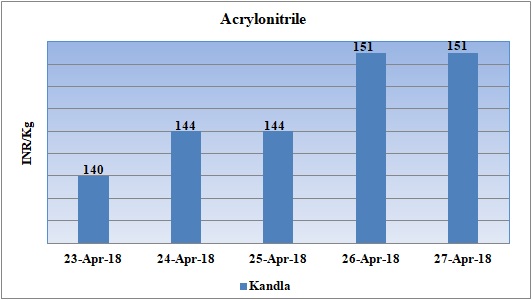

Weekly Price Trend: 23-04-2018 to 27-04-2018

- The above given graph focuses on the ACN price trend from 23rd April to 27th April 2018.

- Domestic prices witnessed a positive trend and prices increased by Rs.14/Kg for bulk quantity.

- Prices were assessed around Rs.151/Kg for bulk quantity by end of the week for Kandla port.

Total ACN import in the month of March 2018

The above table depicts the import of ACN at Kandla port in the month of March 2018.

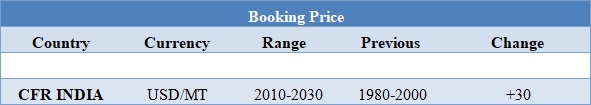

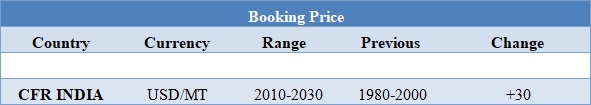

Booking Scenario

The above chart shows the international prices of ACN. CFR India prices of ACN were assessed in the range of USD 20100-2030/MT.

INDIA& INTERNATIONAL

- Prices of ACN were assessed around Rs.151Kg, increased by Rs.14/Kg for bulk quantity in span of one week. The weakened supply in international market has led to hike in domestic values.

- CFR India prices of Acrylonitrile were assessed in the range of USD 2010-2030/MT, increased by USD 30/MT in compare to last week’s closing values.

- Feedstock Propylene market remained stable for this week. FOB Korea values were assessed around USD 1045/MT while CFR China values were assessed around USD 1085/MT while CFR SEA values assessed around USD 960/MT.

- With rise in ACN values in China market and deficit supply has put an additional pressure on ACN values.

- With growing tension between US and China, the Chinese has listed out 125 products under the slab of tax of 25% of tariffs on US import. The list included US ACN as well. The government has not specified the implementation date for this policy yet. China imports around 20% of its requirement of ACN from US. The increased import duty will now cut down their imports. The traders are worried due to implementation of these tariffs as they are affecting the economies of the two nations

- PetroChina Jilin is planning to shut their ACN unit for maintenance turnaround in this week. The unit was likely to go off-stream in the first week of May and is likely to remain shut for around 40 days. China based unit has the manufacturing capacity of 425 kt/annum.

- Sinopec Anqing has shut down their ACN unit in the first week of April. The unit is expected to remain off-stream for around 40 days. The unit is likely to start its production in the third week of May 2018. China based unit has the manufacturing capacity of 210 kt/annum.

- This week oil prices have followed little volatility at the end of the week prices have escalated. On Thursday oil prices increased, supported by expectations of renewed U.S. sanctions on Iran, declining output in Venezuela and ongoing strong demand.

- On Thursday, closing crude values have increased. WTI on NYME closed at $68.19/bbl; prices have increased by $0.14/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.74/bbl in compared to last trading and was assessed around $74.74/bbl.

- Venezuela's plunging output and looming U.S. sanctions against Iran come against a backdrop of strong demand, especially in Asia, the world's biggest oil consuming region. However, not all market indicators point towards tighter supplies. Soaring U.S. oil production and exports are holding back further price gains.

$1 = Rs. 66.66

Import Custom Ex. Rate USD/ INR: 66.70

Export Custom Ex. Rate USD/ INR: 65.00