ACN Weekly Report 30 Dec 2017

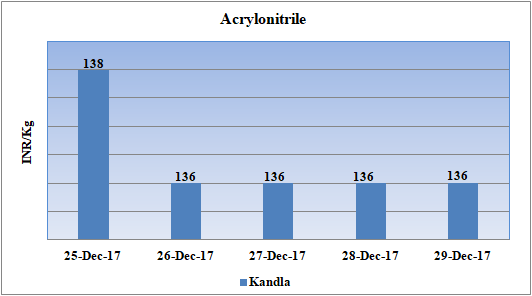

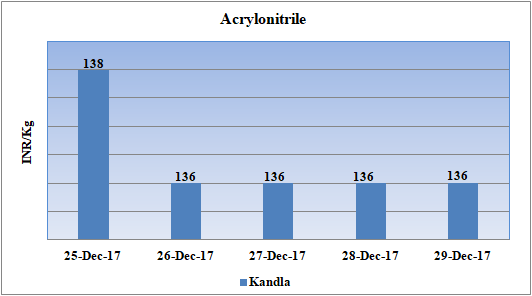

Weekly Price Trend: 25-12-2017 to 29-12-2017

- The above given graph focuses on the ACN price trend from 25th Dec to 29th Dec 2017. In compare to last week’s closing values there has been significant fall in domestic values for this week.

- Domestic prices reduced by Rs.1/Kg and were assessed at the level of Rs.136/Kg for bulk quantity.

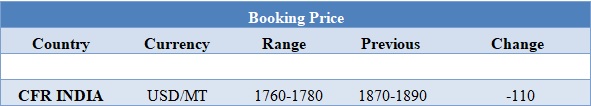

Booking Scenario.

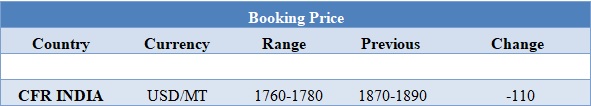

The above chart shows the international prices of ACN. CFR India prices of ACN were assessed in the range of USD 1760-1770/MT.

INDIA& INTERNATIONAL

- After an unprecedented hike in values in last few months the domestic values have been settling down due to normal availability of the chemical in the domestic as well as international market. Prices of ACN were assessed around Rs.136/Kg, reduced by Rs.2/Kg for bulk quantity in span of one week.

- CFR India prices of Acrylonitrile were assessed in the range of USD 1760-1780/MT, heavily reduced by USD 110/MTS in compare to last week’s closing values.

- On other side Propylene market has also been witnessing firmness in prices. With maintenance scheduled in the month of January more progression in values will take place in next few months in Asian markets.

- Propylene the feedstock for ACN values were assessed around FOB Korea USD 935/MT while CFR China values were assessed around USD 990/MT.

This week crude oil prices have remained fluctuating. As 2017 draws to a close, On Thursday oil prices increased on lifted by strong data from top importer China and on increased U.S. refining activity that drew more crude from inventories. Recently, thin trading activity ahead of the New Year weekend.

As per report, market condition has been tight due to ongoing supply cuts led by OPEC, as well as top producer Russia.

On Thursday, closing crude values have increased. WTI on NYME closed at $59.84/bbl; prices have increased by $0.20/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.28/bbl in compared to last trading and was assessed around $66.72/bbl.

As per market analyst, In the first half of 2018, market will remain quite bullish as Saudi Arabia continues to signal its intent to privatize part of Saudi Aramco, the state-owned oil company, in an initial public offering expected in late 2018. As such, the Saudis will be quite motivated to keep prices up going into that sale. The risk to that outlook could become apparent if Russia stops cooperating, which has been a significant tipping factor in the cuts' effectiveness.

$1 = Rs. 63.87

Import Custom Ex. Rate USD/ INR: 64.90

Export Custom Ex. Rate USD/ INR: 63.20