Butyl Acrylate Monomer Weekly Report 01 July 2017

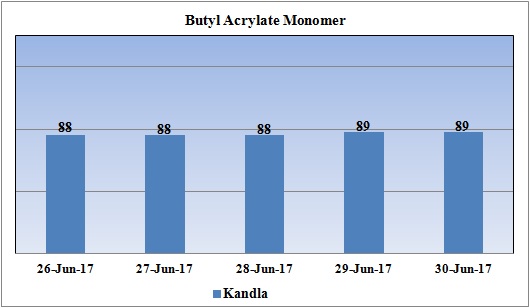

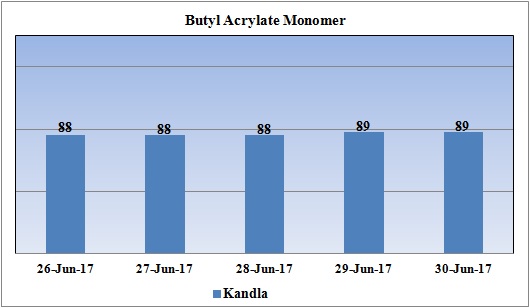

Weekly Price Trend: 26-06-2017 to 30-06-2017

- The above given graph focuses on the Butyl Acrylate Monomer price trend for current week.

- If we take a quick look at the above given weekly prices, it can be observed that prices increased for this week.

- Prices of BAM were assessed at the level of Rs.89/Kg for ex Kandla for bulk quantity with a decrease of Rs.4/Kg for bulk quantity.

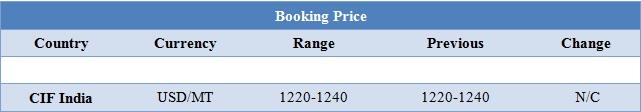

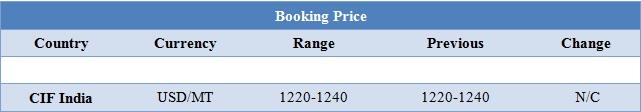

Booking Scenario

The above chart shows the international prices of BAM and its comparison from the previous prices. On Friday CFR India prices of BAM prices decreased heavily this week.

INDIA & INTERNATIONAL

- BAM prices increased in domestic market for this week. By end of this week prices were assessed at the level of Rs.89/Kg improved Rs.1/Kg in compare to last week’s closing values.

- CIF India prices of BAM were assessed at the level of USD 1220-1240/MT (Full Duty), with no change in compare to last week’s closing values. This has been due to mixed price trend in crude values in global market.

- Crude oil prices have followed positive inclination as the fall in U.S. production has bolstered markets this week.

- On Thursday, closing crude values have increased.WTI on NYME closed at $44.93/bbl, prices have increased by $0.19bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.11/bbl in compared to last trading and was assessed around $47.42/bbl.

- After the steep drop in oil prices of recent weeks, market players said that especially hedge funds saw nice buying momentum and lower U.S. crude production was the trigger to act.

- U.S. crude output dropped 100,000 barrels per day (bpd) to 9.3 million bpd last week, the steepest weekly fall since July 2016.

- As per market players recently market is cyclically bullish within a structurally bearish framework, noting that global inventories were drawing, demand is high, OPEC could still make deeper cuts and U.S. producers could be discouraged by rising costs.

- OPEC delegates have indicated they will not rush to implement further cuts to crude output. However, pressure from investors amid a relentless global supply overhang could prompt the group to consider further steps to support the market at its upcoming meeting in Russia next month

$1 = Rs. 64.58

Import Custom Ex. Rate USD/ INR: 65.15

Export Custom Ex. Rate USD/ INR: 63.50