C9 Weekly Report 06 May 2017

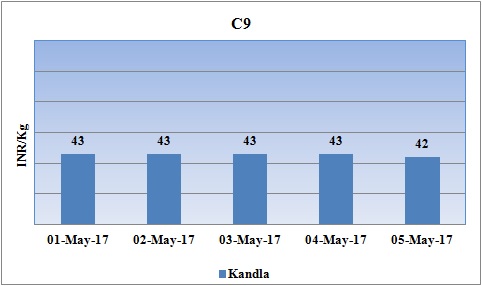

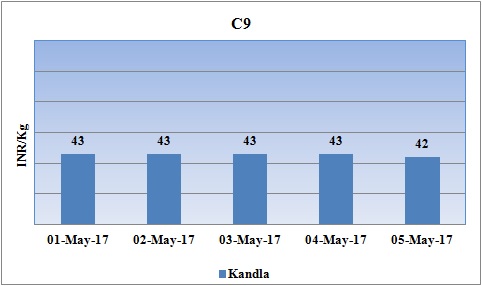

Weekly Price Trend: 01-05-2017 to 05-05-2017

- The above given graph focuses on the C9 price trend for the current week.

- Domestic prices of C9 reduced slightly for this week. Prices were assessed at the level of Rs.42/Kg for bulk quantity by closing of market.

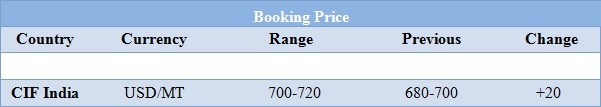

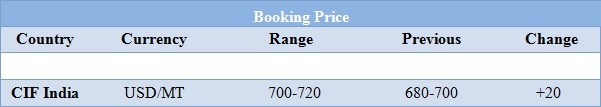

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices reduced for this week. Prices were assessed at the level of Rs.42/Kg for bulk quantity.

- There has been slight rise in international prices in compare to last week’s closing values. CIF India prices were assessed at the level of USD 700-720/MTS, with an increase of USD 20/MTS for this week.

- Price trend in crude values continue to remain volatile. As week proceeded the weakening of crude values was observed. On Thursday oil prices crashed to five-month lows as concerns about global oversupply wiped out all of the price gains since OPEC's move to cut output.

- Analysts agreed the steep price falls would likely force OPEC members to extend production cuts later this month, but the prospect of deeper cuts appeared wiry. Again OPEC is scheduled to meet on May 25 to decide whether to extend the cuts.

- On Thursday, closing crude values decreased.WTI on NYME closed at $45.52/bbl, prices decreased by $2.30/bbl in compared to last closing values. While Brent on Inter Continental Exchange decreased by $2.41/bbl in compared to last trading and was assessed around $48.38/bbl.

- Market experts believe that the current rate of cuts is sufficient to result in demand outstripping global output by 1 million barrels a day in the second half of 2017 as seasonal demand picks up. It is becoming apparent that the profit margins of many of the chemical majors could be improved as oil prices have been declining with great pace.

$1 = Rs. 64.37

Import Custom Ex. Rate USD/ INR: 65.10

Export Custom Ex. Rate USD/ INR: 63.40