C9 Weekly Report 23 June 2018

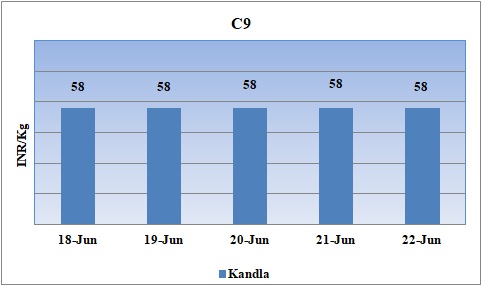

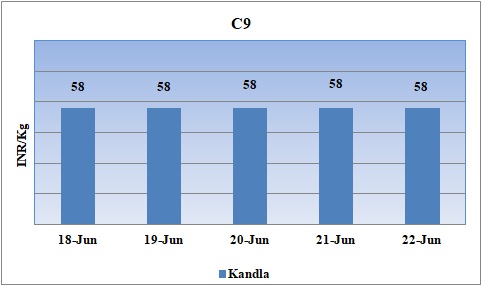

Weekly Price Trend: 18-06-2018 to 22-06-2018

- The above given graph focuses on the C9 price trend for the current week.

- Domestic prices of C9 remained firm for this week. Prices were assessed at the level of Rs.58/Kg for bulk quantity by closing of market.

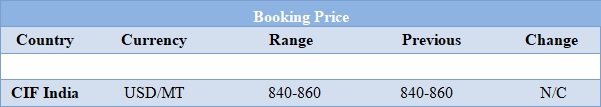

Booking Scenario

INDIA& INTERNATIONALs

- Domestic prices remained firm for this week. Prices were assessed at the level of Rs.58/Kg for bulk quantity.

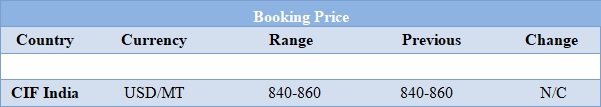

- Prices in international market remained stable for this week. CIF India prices were assessed at the level of USD 850-870/MTS in this week.

- There has been chaos in international prices as custom Indian exchange rate has also increased to significant level. Crisis in international market due to imposition of trade tariffs on China by US and even India has also imposed tariffs on imports of goods from US.

- This week crude oil prices have followed volatile trend. on Thursday Global benchmark Brent crude extended losses ahead of Friday's meeting of the OPEC, where producers are expected to boost output.

- On Thursday, closing crude values have plunged. WTI on NYME closed at $65.54/bbl; prices have decreased by $0.17/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $1.69/bbl in compare to last closing price and was assessed around $73.05/bbl.

- Today oil prices rose by more than 1 percent in early Asian trading, pushed up by uncertainty over whether OPEC would manage to agree a production increase at a meeting in Vienna later in the day.

- Iran had been expected to oppose any rise in crude output, but it has now signalled it may support a small increase. As per report, presently oil market had now rebalanced and its aim was to prevent a shortage of crude in future that could squeeze the market.

1$ = Rs. 67.84

Import Custom Ex. Rate USD/ INR: 69.10

Export Custom Ex. Rate USD/ INR: 67.40