C9 Weekly Report 25 March 2017

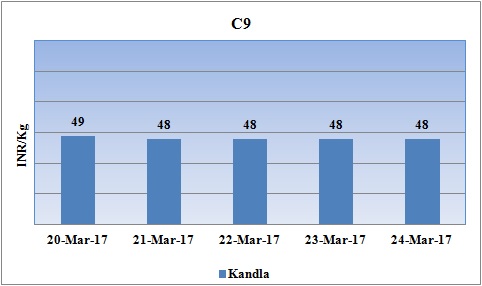

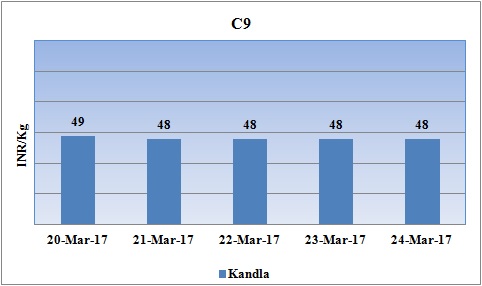

Weekly Price Trend: 20-03-2017 to 24-03-2017

- The above given graph focuses on the C9 price trend for the current week.

- Domestic prices of C9 slightly decreased for this week. Prices were assessed at the level of Rs.48/Kg for bulk quantity by closing of market.

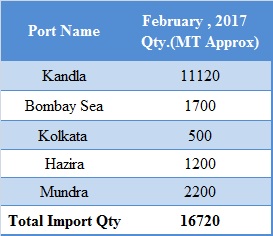

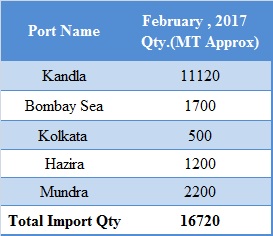

Total import at various ports in the month of February 2017

The above chart depicts the import of C9 at various ports of India in the month of February 2017.

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices reduced slightly for this week. Prices were assessed at the level of Rs.48/Kg for bulk quantity.

- This week C9 prices reduced significantly. CIF India prices were assessed at the level of USD 690-710/MTS, with a decrease of USD50/MTS in compare to last assessed values.

- Price trend for crude values remained thin with very few changes. Oil prices plunged initially as U.S. crude inventories increased faster than expected, piling pressure on OPEC to extend output cuts beyond June. Now investors await a meeting between OPEC and its allies that may signal whether they will extend output curbs.

- As per sources, American crude output continued to rise along with inventories, while OPEC won’t formally decide until May whether to extend production curbs, officials will meet this weekend in Kuwait to discuss their deal’s progress.

- Market analyst said that without the production cut agreement, prices could basically target the low-to-mid $30s, players are positive that they will extend production cut. Some players are anticipating lowering prices due to high supplies.

- On Monday WTI were closed at $49.31 and Brent closed at $51.76 while on Thursday, closing crude values have decreased.WTI on NYME closed at $47.70/bbl, prices have decreased by $0.34/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.08/bbl in compared to last trading and was assessed around $50.56/bbl.

$1 = Rs. 65.41

Import Custom Ex. Rate USD/ INR: 66.20

Export Custom Ex. Rate USD/ INR: 64.50