C9 Weekly Report 29 April 2017

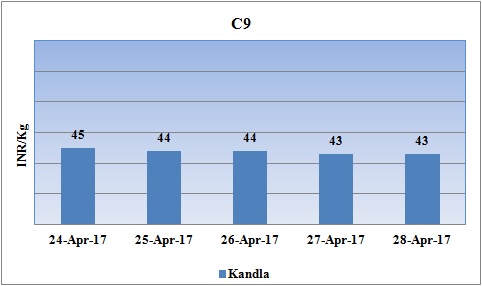

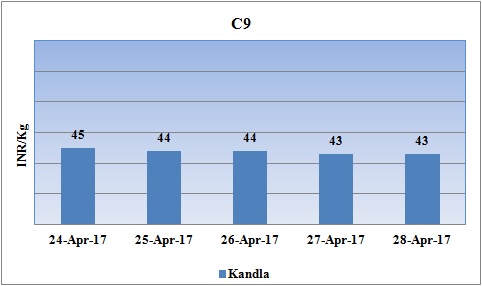

Weekly Price Trend: 24-04-2017 to 28-04-2017

- The above given graph focuses on the C9 price trend for the current week.

- Domestic prices of C9 reduced slightly for this week. Prices were assessed at the level of Rs.43/Kg for bulk quantity by closing of market.

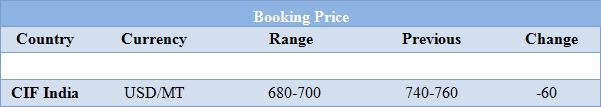

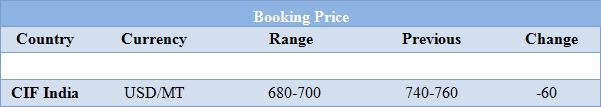

Booking Scenario

INDIA& INTERNATIONAL

- Domestic prices reduced slightly for this week in domestic market. Prices were assessed at the level of Rs.42/Kg for bulk quantity.

- Similar trend was observed in international market. CIF India prices were assessed at the level of USD 680-700/MTS.

- Throughout the week oil prices remained volatile. As per recent records oil prices reduced sharply.WTI from $53 a barrel, down to $48 while Brent declined from $55 to $51. The falling oil means weakening of economy, the reality is that oil is being driven by increased supply. On Thursday oil prices have plunged as the resume of two key Libyan oilfields and concerns about dreary gasoline demand fed concern over whether major oil producers can lessen the glut of global inventories.

- On Thursday, closing crude values have decreased.WTI on NYME closed at $48.97/bbl, prices have increased by $0.65/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.38/bbl in compared to last trading and was assessed around $51.44/bbl.

- As per market analyst As gas prices dropped, it created an undertow for the entire crude oil market. The outlook for oil prices will remain unstable. Decline in crude prices and therefore petroleum product prices also means corresponding reduction in prices of some of the raw materials for the petrochemical industry. Hence, it can be a factor in improving the profitability of that industry.

$1 = Rs. 64.24

Import Custom Ex. Rate USD/ INR: 65.55

Export Custom Ex. Rate USD/ INR: 63.85