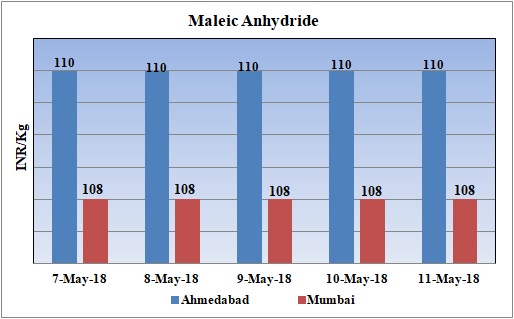

Maleic Anhydride Weekly Report 12 May 2018

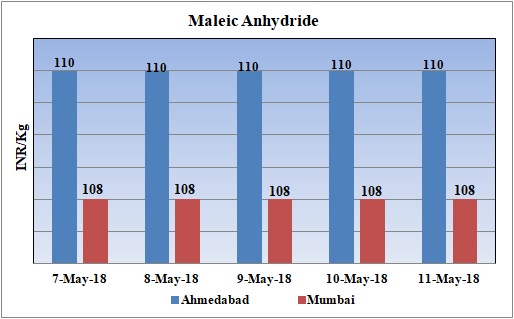

Weekly Price Trend: 07-05-2018 to 11-05-2018

- The above given graph focuses on the Maleic Anhydride price trend for the current week.

- This week, there has been hike in the domestic prices.

- Prices were assessed at the level of Rs.108-110/Kg for Ahmedabad and Mumbai regions.

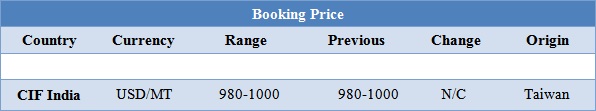

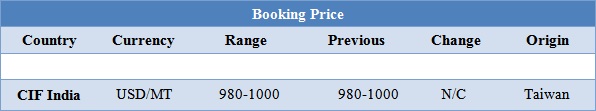

Booking Scenario

The above chart shows the international price of Maleic Anhydride for this week. It shows that the prices for Maleic Anhydride have remained firm for this week.

INDIA & INTERNATIONAL

- Maleic Anhydride prices remained firm for this week. Prices were assessed at the level of Rs.108-110/Kg for Ahmedabad and Mumbai for bulk quantity.

- International prices have remained stable for this week.

- CIF India prices of Maleic Anhydride were assessed at the level of USD 980-1000/MT, for Taiwan origin material, with no change for this week.

- This week with the little volatility oil prices have escalated sharply. On Thursday as traders adjusted to the prospects of renewed U.S. sanctions against major crude exporter Iran amid an already tightening market.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $69.06/bbl; prices have decreased by $1.67/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $1.32/bbl in compared to last trading and was assessed around $74.85/bbl.

- The United States plans to impose new sanctions against Iran, which produces around 4 percent of global oil supplies, after dump an agreement reached in late 2015 which limited Tehran's nuclear ambitions in exchange for removing U.S.-Europe sanctions.

- As per analysts oil prices to rise to $80-$100 per barrel later this year, once U.S. sanctions start to bite and Iran's exports start sinking. Market players said that OPEC will step up output in order to counter the Iran disruption."The market is now focused on OPEC and other producers' ability to react to this potential supply disruption,"

- "Investors are increasingly viewing Kuwait and Iraq as the producers with the best ability to raise output quickly in response to any fall in Iranian exports.

$1 = Rs. 67.33

Import Custom Ex. Rate USD/ INR: 67.50

Export Custom Ex. Rate USD/ INR: 65.80