Maleic Anhydride Weekly Report 3 Feb 2017

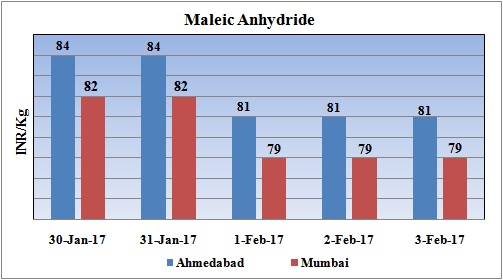

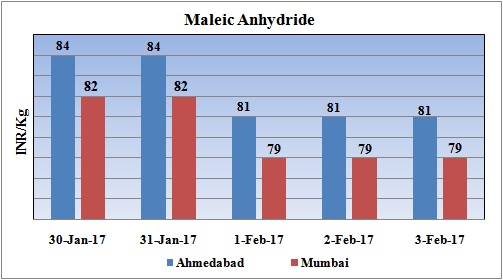

Weekly Price Trend: 30-01-2017 to 03-02-2017

- The above given graph focuses on the Maleic Anhydride price trend for the current week.

- This week, there has been significant fall in domestic values.

- There has been decline in domestic values for Maleic Anhydride. Prices were assessed at the level of Rs.81-79/Kg for Ahmedabad and Mumbai ports.

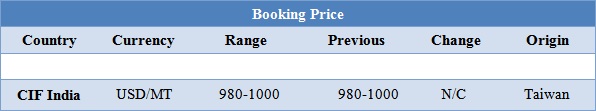

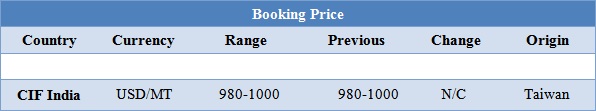

Booking Scenario

The above chart shows the international price of Maleic Anhydride for this week. It shows that the prices for Maleic Anhydride have remained firm for this week.

INDIA & INTERNATIONAL

- Maleic Anhydride prices decreased for this week. Prices were assessed at the level of Rs.81-79/Kg for Ahmedabad and Mumbai for bulk quantity.

- International prices have remained stable for this week.

- CIF India prices of Maleic Anhydride were assessed at the level of USD 980-1000/MT, for Taiwan origin material, with no change for this week.

- Asian markets remained stable as key player China has been out of focus. Chinese markets are closed on back of mini vacation to celebrate Dragon festival. Market activities will resume its operations in next week.

- Oil prices remained volatile for this week. On Thursday oil prices settled on lower note as rising oil stockpiles in American storage facilities has maintained a balance with respect to cutting down of production by OPEC and other major exporters.

- U.S. crude oil inventories rose last week by an unexpected 6.5 million barrels to 494.76 million barrels. Recently Heightened tensions raise fears that the United States will pull out of the Iran nuclear deal or impose new sanctions, which could affect Tehran's ability to continue ramping up oil production.

- According to market reports, crude oil imports were increased again and market has been bullish, as the Gulf Coast considering a big increase in crude oil inventories. Market players have said that any expectations of a sustained recovery in price will depend on increasing efforts by OPEC to curb output though the prospect of an upside breakout will be destabilized by the growing revival in U.S. crude production.

- On Thursday, closing crude values have plunged.WTI on NYME closed at $53.54/bbl, prices have decreased by $0.34/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.24/bbl in compared to last trading and was assessed around $56.56/bbl.

$1 = Rs. 67.31

Import Custom Ex. Rate USD/ INR: 68.40

Export Custom Ex. Rate USD/ INR: 66.70