MEG Weekly Report 05 May 2018

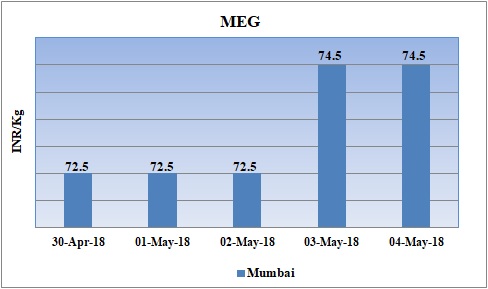

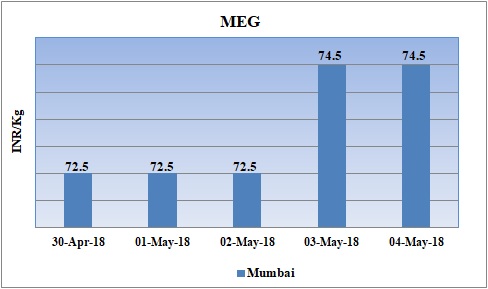

Weekly Price Trend: 30-04-2018 to 04-05-2018

- The above given graph focuses on the MEG price trend from 30th April to 4th May 2018.

- Prices remained firm for this week. Domestic prices were assessed at the level of Rs.74.5/Kg for bulk quantity.

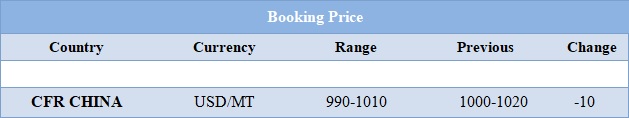

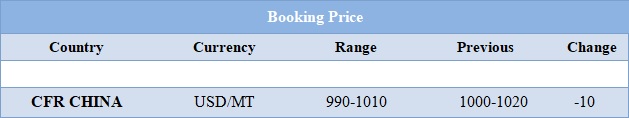

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained firm for bulk quantity. Prices were assessed at the level of Rs.74.5/Kg for bulk quantity.

- CFR China values were assessed around USD 990-1010/MT, reduced by USD 10/MT in one week. CFR South East Asia assessed around USD 1005/MT again reduced by USD 10/MT in last one week.

- FOB Korea values for Ethylene were assessed around USD 1250/MT, reduced by almost USD55/MT for this week while CFR China values were assessed around USD 1255/MT, while CFR South East Asia values were assessed around USD 1225/MT.

- On other side Propylene market has also decreased for this week. FOB Korea values were assessed around USD 1040/MT while CFR China values were assessed around USD 1080MT.

- Mitsui Chemical has announced its maintenance schedule for naphtha cracker based at Sakai. The cracker is likely to go off-stream in the mid of June and will resume production only in July.

- Cracker is based at Sakai in Japan and has the manufacturing capacity of Propylene around 2,80,000 mt/year and Ethylene around 5,00,000 mt/year. Last week the company announced its maintenance schedule for at Kashima based cracker which will go off-stream in the last week of May and will resume production after two months.

- China National Offshore Oil Corporation (CNOOC) and Shell Nanhai B.V. (Shell) have announced the official start-up of the second ethylene cracker at their Nanhai petrochemicals complex in Huizhou, Guangdong Province, China. The new ethylene cracker increases ethylene capacity at the complex by around 1.2 million tonnes per year, more than doubling the capacity of the complex, and benefits from a deep integration with adjacent CNOOC refineries. The new facility will also include a styrene monomer and propylene oxide (SMPO) plant, which will be the largest in China when it begins operations.

- The petrochemicals complex produces olefins and derivative products that are used in a wide range of industrial and consumer products, including household appliances, cars, furniture and computers.

- This week crude oil prices have fluctuated. On Thursday, prices boosted by OPEC production cuts and the potential for new U.S. sanctions against Iran, but gains were limited by growing U.S. crude inventories.

- On Thursday, closing crude values have increased. WTI on NYME closed at $68.43/bbl; prices have increased by $0.50/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.26/bbl in compared to last trading and was assessed around $73.62/bbl.

- As per report, U.S. oil production also rose to a record of 10.62 million barrels per day (bpd), a jump of more than a quarter since mid-2016. Looming over markets is the May 12 deadline by when President Donald Trump is due to decide whether or not to continue waiving U.S. sanctions against Iran.

$1 = Rs. 66.86

Import Custom Ex. Rate USD/ INR: 67.50

Export Custom Ex. Rate USD/ INR: 65.80