MEG Weekly Report 07 July 2018

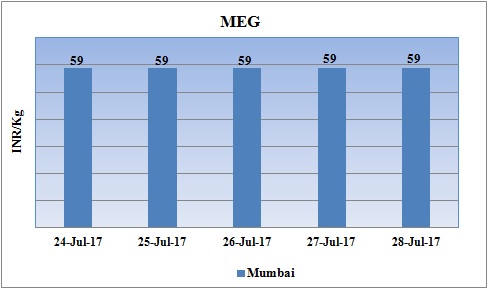

Weekly Price Trend: 24-07-2017 to 28-07-2017

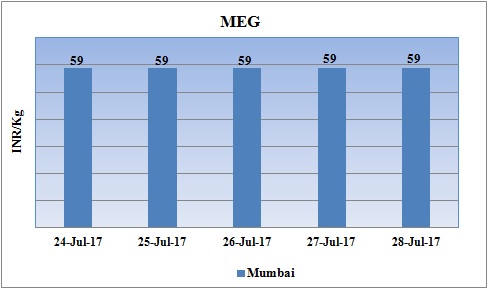

- The above given graph focuses on the MEG price trend from 24th July to 28th July 2017.

- Prices remained unchanged for this week. Domestic prices were assessed at the level of Rs.59/Kg for bulk quantity with no change in compare to last week’s closing values.

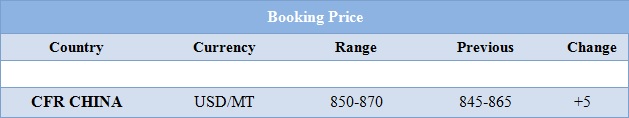

Booking Scenario

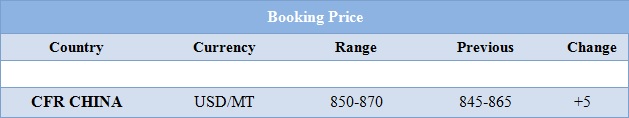

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained unchanged. Prices were assessed at the level of Rs.59/Kg for bulk quantity.

- Some correction was seen in the values after last week’s heavy gain. CFR China values were assessed around USD 85-870/MTS increased by USD 5/MT in compare to last week’s assessed values.

- CFR SEA prices for MEG were assessed around USD 865/MT for this week decreased by USD 35/MTS in one week. FOB Korea values for Ethylene was assessed around USD 890/MTS remained unchanged while CFR China values for Ethylene were assessed around USD 925/MTS.

- There has been glut in supply as majority of the states are receiving heavy showers. Gujarat has been worst affected due to heavy rainfall. All the major highways an railways have been affected by water logging. Rescue operation is all around the state is going on. The situation will take few more days to return to its normal pace.

- This week oil prices floated on positive trend. On Thursday oil prices closed on 8 week high levels on a hope that a steeper-than-expected decline in U.S. crude oil inventories will pull down global oversupply. On Thursday, closing crude values have increased.WTI on NYME closed at $49.04/bbl, prices have increased by $0.29/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.52/bbl in compared to last trading and was assessed around $51.49/bbl.

- As per report, U.S. crude stocks fell sharply last week as refineries increased output and imports declined, while gasoline stocks decreased and distillate inventories fell.

- Some players believe that the long-oversupplied market is moving towards balance which was also supported by news that Saudi Arabia plans to limit crude exports to 6.6 million barrels per day (bpd) in August, about 1 million bpd below the level last year.

- Some producers announced plans to cut spending this year as a result of low oil prices. But analysts say oil prices may have little room to head higher as recent gains could encourage more output, particularly from U.S. shale producers with low costs. The market will likely be paying even more attention to drilling activity in the U.S. in the coming weeks.

$1 = Rs. 68.87

Import Custom Ex. Rate USD/ INR: 65.20

Export Custom Ex. Rate USD/ INR: 63.50