MEG Weekly Report 08 July 2017

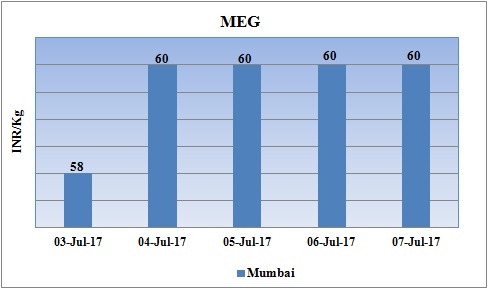

Weekly Price Trend: 03-07-2017 to 07-07-2017

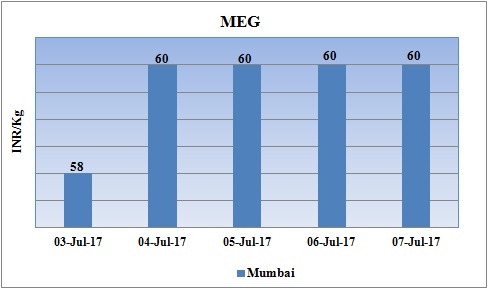

- The above given graph focuses on the MEG price trend from 3rd July to 7th July 2017.

- Prices remained increased for this week. Domestic prices were assessed at the level of Rs.60/Kg for bulk quantity with no change in compare to last week’s closing values.

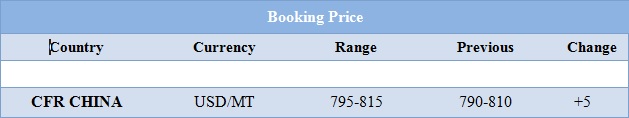

Booking Scenario

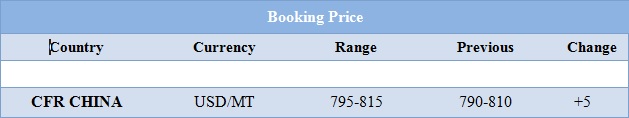

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices significantly increased. Prices were assessed at the level of Rs.60/Kg for bulk quantity.

- CFR China values increased by USD 5/MTS in compare to last week’s assessed values and were assessed in the range of USD 795-815/MT

- CFR SEA prices for MEG were assessed around USD 810/MT for this week. FOB Korea values for Ethylene was assessed around USD 890/MTS reduced by USD25/MTS while CFR China values for Ethylene were assessed around USD 925/MTS, declined by USD 40/MTS in one week.

- FOB Korea values for Propylene was assessed around USD 820/MTS while CFR China values were assessed around USD 870/MTS.

- This week oil prices followed volatile trend. On Thursday oil prices closed on slightly higher note after a sharp but short-lived boost from a much bigger-than-expected decline in U.S. inventories of crude oil and gasoline. WTI on NYME closed at $45.52/bbl, prices have increased by $0.39/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.32/bbl in compared to last trading and was assessed around $48.11/bbl. Market players said the surge was driven by traders closing out short positions, or bets that oil prices would fall.

- There's a lot of bearishness out there now the market still believes supplies are not going to be in balance globally. Investors believe the OPEC will need to make further output cuts to offset thriving shale production in the United States.

- U.S. gasoline stocks dropped 3.7 million barrels in the most recent week, far exceeding the expected drop of 1.1 million barrels. Still, gasoline inventories remain about 6 percent above seasonal averages, so investors will watch for July data to see if demand is strong enough to whittle down stocks.

$1 = Rs. 64.59

Import Custom Ex. Rate USD/ INR: 65.65

Export Custom Ex. Rate USD/ INR: 63.95