MEG Weekly Report 08 Sep 2018

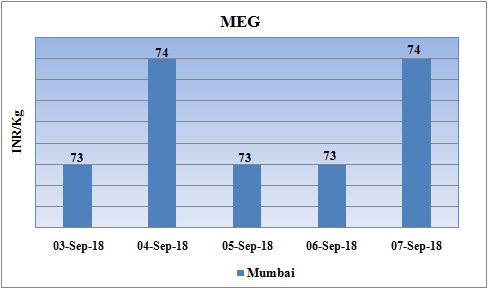

Weekly Price Trend: 03-09-2018 to 07-09-2018

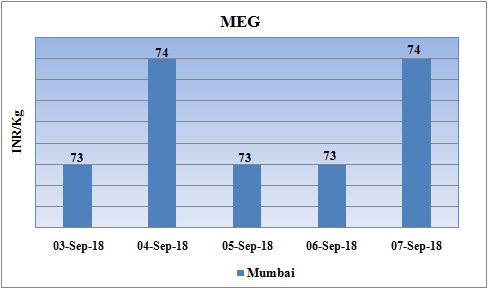

- The above given graph focuses on the MEG price trend from 3rd Sept to 7th Sept 2018.

- Prices remained stable-to-firm for this week. Domestic prices were assessed at the level of Rs.74/Kg for bulk quantity.

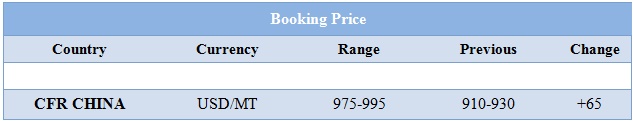

Booking Scenario

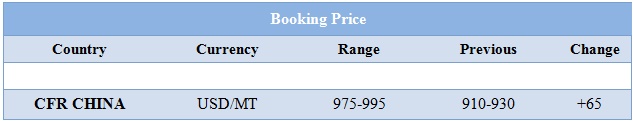

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained vulnerable for bulk quantity. Prices were assessed at the level of Rs.74/Kg for bulk quantity.

- CFR China values were assessed around USD 975-995/MT, significantly increased by USD 65/MT for this week. CFR South East Asia assessed around USD 1000/MT.

- FOB Korea values for Ethylene were assessed around USD 1345/MT, while CFR China values were assessed around USD 1320/MT and CFR South East Asia values were assessed around USD 1220/MT.

- On other side Propylene market increased for this week. FOB Korea values were assessed around USD 1080/MT while CFR China values were assessed around USD 1135/MT.

- In compare to MEG values prices for Ethylene and Propylene has reduced heavily in the international market.

- The soaring of prices in China market is due to tariffs imposed by US on China. The china market is now feeling its share of clinch. The other factors such as strict government controls on industrial activities for environment protection purposes and the ongoing stiff between US and China.

- Many other downstream factories in China are not operating at full rate as they are highly anxious that the trading disputes these environmental measures will continue to stay for long in the future.

- State owned company Indian Oil Corp (IOC) is planning to start its MEG in Odisha by 2021. The plant will be located at IOC’s petrochemical complex linked to its 15m tonne/year Paradip refinery. The company has taken the necessary approvals and licenses for the same. The plant is likely to be commissioned by April 2021. OC also plans to build a 1.2m tonne/year purified terephthalic acid (PTA) plant at the site. The project will incur an investment of Rs 145bln . IOC also plans to invest Rs20bn in a 108,000 tonne/year polyester staple fibre (PSF) plant. IOC also plans to expand capacities at its Panipat refinery in Haryana state; Koyali refinery in Gujarat state; Barauni refinery in Bihar state; and Mathura refinery in Uttar Pradesh state.

- There has been continuous soaring in crude prices in this week. The US inventories have fell to their lowest levels since February 2015. US West Texas Intermediate (WTI) crude futures were at $67.90 per barrel at 0056 GMT, up 13 cents, or 0.2 per cent, from their last settlement. International Brent crude futures climbed 12 cents, or 0.2 per cent, to $76.62 a barrel. With release of Oil inventory data last night, a large number has been drawn from crude inventories.

- Global oil markets have tightened over the last month, pushing up Brent prices by more than 10 per cent since the middle of August. Investors anticipate less supply from Iran as US sanctions on Tehran begin to bite.

- With ship-tracking data now pointing at a reduction in Iranian exports, renewed strife in Libya, and Venezuelan export availability hobbled by an accident at the key Jose terminal, the list of bullish headlines is getting longer,” said Michael Dei-Michei, head of research at Vienna consultancy JBC Energy.

- US is quite actively tracking the flow of crude and has managed to use its sanctions very actively against Iran. They are forcing many western companies to cease export from Iran and avoid trading with them.

- Contrary to this India and China are making efforts to continue their imports from using one or other way. Global oil markets have tightened over the last month, pushing up Brent prices by more than 10 per cent since the middle of August. Investors anticipate less supply from Iran as US sanctions on Tehran begin to bite.

$1 = Rs. 71.73

Import Custom Ex. Rate USD/ INR: 71.10

Export Custom Ex. Rate USD/ INR: 69.40