MEG Weekly Report 09 Dec 2017

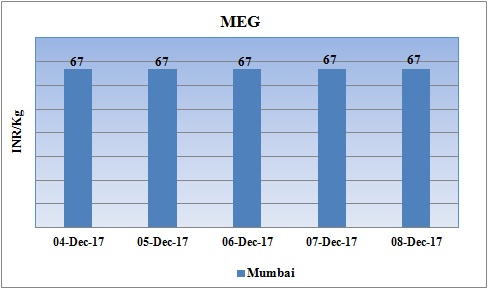

Weekly Price Trend: 04-12-2017 to 08-12-2017

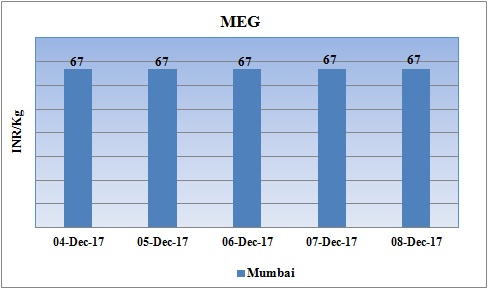

- The above given graph focuses on the MEG price trend from 4th Dec to 8th Dec 2017.

- Prices remained unchanged for this week. Domestic prices were assessed at the level of Rs.67/Kg reduced by Rs.1/Kg sin compare to last week’s closing values.

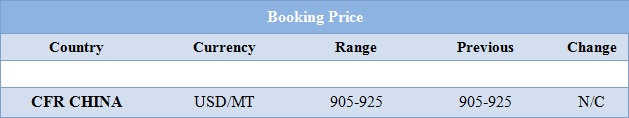

Booking Scenario

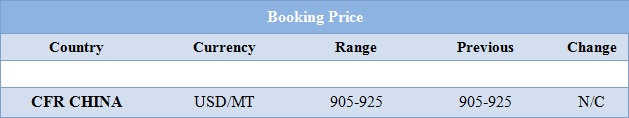

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained stable for bulk quantity. Prices were assessed at the level of Rs.67/Kg for bulk quantity.

- CFR China values were assessed around USD 905-925/MT, with no change in compare to last week’s assessed values.

- CFR China Ethylene values were assessed around USD 1310/MT while FOB Korea values were assessed around USD 1255/MT.

- CFR China Propylene values were assessed around USD 970/MT while FOB Korea values were assessed around USD 905/MT.

- Kuwait’s Petrochemicals Equate Petrochemical has restarted its MEG unit recently. Earlier the unit was shut down in first week of November for annual maintenance. The unit is based in Kuwait and has the production capacity of 615 Kt/year.

- Kuwait Olefins Co has restarted production at its cracker post brief maintenance schedule. Earlier the unit was shut down in last week of October for annual maintenance schedule. Unit is based at Shuaiba in Kuwait and has the Ethylene production capacity of 85,000 mt/year.

- Crude oil prices remained mixed for this week. Oil rose on Thursday indicating that investors are doubtful of pushing the market lower in response to an unexpectedly large rise in U.S. stocks of refined products that has increased concern about the demand outlook.

- On Thursday, closing crude values have increased. WTI on NYME closed at $56.69/bbl; prices have increased by $0.73/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.98/bbl in compared to last trading and was assessed around $62.20/bbl.

- On Friday oil prices dipped as the U.S. dollar strengthened, although OPEC-led supply cuts are seen supporting markets going into next year.

- As per market players, Soaring U.S. output threatens to undermine efforts led by the OPEC and Russia to bring production and demand into balance following years of oversupply. The market suggests that the bull market is not as strong as earlier predicted. Oil prices saw a sharp 2.9 percent decline after the US published its inventory data. Analysts expect that oil prices to move in a price band of USD 45 to USD 60 for the calendar year 2018.

$1 = Rs. 64.46

Import Custom Ex. Rate USD/ INR: 65.40

Export Custom Ex. Rate USD/ INR: 63.70