MEG Weekly Report 09 Sep 2017

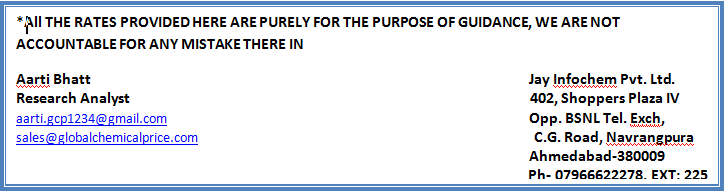

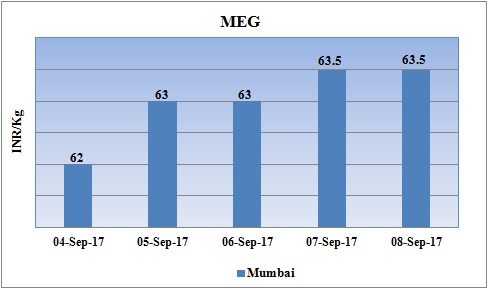

Weekly Price Trend: 04-09-2017 to 08-09-2017

- The above given graph focuses on the MEG price trend from 4th Sept to 8th Sept 2017.

- Prices increased significantly for this week. Domestic prices were assessed at the level of Rs.63.5/Kg for bulk quantity, increased by Rs.1.5/Kg for bulk quantity in compare to last week’s closing values.

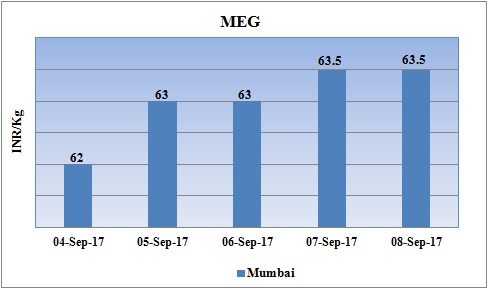

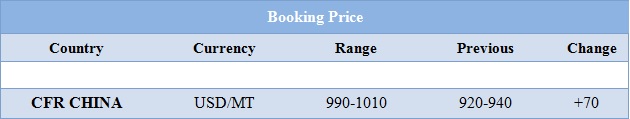

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices witnessed a rise in values. Prices were assessed at the level of Rs.63.5/Kg for bulk quantity.

- CFR China values were assessed around USD 990-1010/MTS with a rise of USD 70/MTS in compare to last week’s assessed values.

- MEGlobal the wholly owned subsidiary of Kuwait’s Petrochemicals Equate Petrochemical will shut down its MEG unit for maintenance turnaround. Equate will be conducting a major turnaround of its MEG unit in the third quarter of 2017. Equate's MEG capacity in Kuwait has a nameplate capacity of 1.2 million mt/year. As a result there will be loss in the production of 70,000 – 1,00,000 mt/year. Due to this turnaround schedule the company will shelve its supply to Middle East, Turkey, India and Pakistan.

- The basic material used in the manufacturing of plastics, Ethylene supply has been completely disrupted in the country. It’s used to make polyester for both textiles and water bottles. Ethylene is an ingredient in vinyl products such as PVC pipes, life-saving medical devices and sneaker soles. Texas alone produces three quarters of the country’s supply of Ethylene. The major producers like LyondellBasell, ExxonMobil and Chevron Phillips Chemical Co has shut down their major units. It could take a week or longer to re-start refineries and plants. 1.3m bbl/day of refining capacity was being re-started on Friday.

- This week oil prices have followed mixed trend. Oil futures eased on Thursday on a slightly bigger-than expected U.S. crude inventory build as the restart of U.S. refiners after Hurricane Harvey was being countered by the threat of Hurricane Irma. On Thursday, closing crude values have remained mixed.WTI on NYME closed at $49.09/bbl, prices have decreased by $0.07/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.29/bbl in compared to last trading and was assessed around $54.49/bbl. As per market players supplies of crude remained sufficient to meet demand.

- The major petrochemical plants of the country are located on these sites. To take a precautionary action major companies like Exxon Mobil, LyondellBasel, Celanese and many more has shut down their units abruptly. Formosa has shut down its ports and units along with Dow chemical. Petrobras has shut down its Pasadena refinery. Shell has shut down its refinery and unit. Arkema reported explosion in its unit on Thursday.

- There has been rise in international prices in international market. Due to heavy rainfall and disruption of transportation there has been limited supply of the chemical across all major Indian markets.

$1 = Rs. 63.78

Import Custom Ex. Rate USD/ INR: 64.90

Export Custom Ex. Rate USD/ INR: 63.25