MEG Weekly Report 10 March 2018

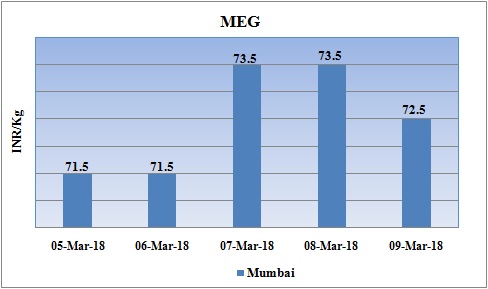

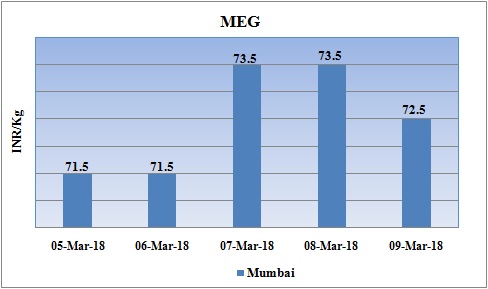

Weekly Price Trend: 05-03-2018 to 09-03-2018

- The above given graph focuses on the MEG price trend from 5th March to 9th March to 2018.

- Prices remained variable for this week. Domestic prices were assessed at the level of Rs.72.5/Kg for bulk quantity.

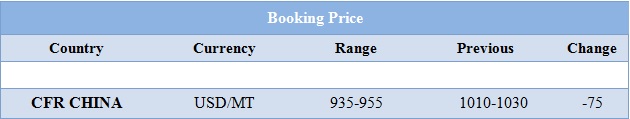

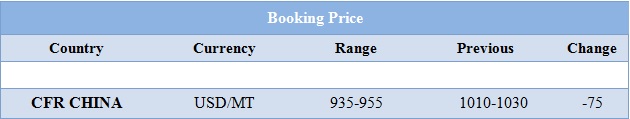

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained firm for bulk quantity. Prices were assessed at the level of Rs.72.5/Kg for bulk quantity.

- CFR China values were assessed around USD 935-955MT, heavily reduced by USD 75/MT in span of last two weeks.

- CFR South East Asia assessed around USD 955/MT again reduced by USD 75/MT in last two weeks.

- FOB Korea values for Ethylene were assessed around USD 1185/MT, reduced by USD 55/MTS while CFR China values were assessed around USD 1260/MT, reduced by USD 30/MTS in last two weeks.

- Propylene market has also reduced for this week. FOB Korea values were assessed around USD 1040/MT while CFR China values were assessed around USD 1095MT. With maintenance scheduled in the month of January more progression in values will take place in next few months in Asian markets.

- This week oil prices have remained volatile. On Thursday oil prices fell headed for a second straight weekly drop on a stronger dollar, signs of an inventory build at the U.S. storage hub in Cushing, Oklahoma, surging U.S. crude production and investor jitters about a potential trade war.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $60.12/bbl; prices have decreased by $1.03/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.73/bbl in compared to last trading and was assessed around $63.61/bbl.

- On Friday, crude oil futures rose as Asian stock markets gained on North Korean leader Kim Jong Un will meet with U.S. President Donald Trump..

- As per report, U.S. crude output is expected to surge beyond 11 million bpd by late 2018, limiting the effectiveness of output cuts by the Organization of the Petroleum Exporting Countries, Russia and other producers.

$1 = Rs. 65.16

Import Custom Ex. Rate USD/ INR: 66.10

Export Custom Ex. Rate USD/ INR: 64.40