MEG Weekly Report 13 Jan 2018

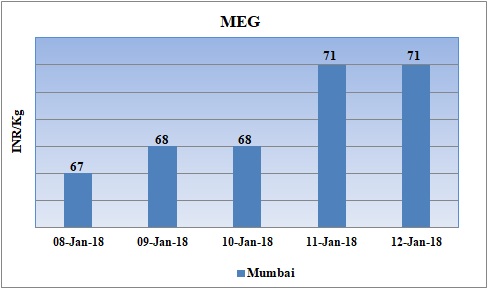

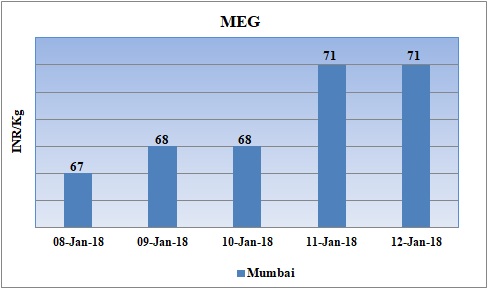

Weekly Price Trend: 08-01-2018 to 12-01-2018

- The above given graph focuses on the MEG price trend from 8th Jan to 12th Jan 2018.

- Prices increased significantly for this week. Domestic prices were assessed at the level of Rs.71/Kg for bulk quantity.

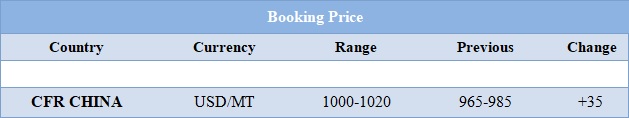

Booking Scenario

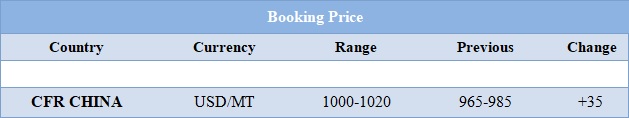

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONALs

- This week domestic prices increased heavily for bulk quantity. Prices were assessed at the level of Rs.67/Kg for bulk quantity.

- CFR China values were assessed around USD 1000-1020MT, increased by USD 35/MTS in compare to last week’s assessed values.

- CFR South East Asia assessed around USD 1015/MT increased by USD 35/MTS in compare to last week’s closing values.

- FOB Korea values for Ethylene were assessed around USD 1370/MT, while CFR China values were assessed around USD 1340/MT.

- Strong buying sentiments coupled with healthy demand has been dominating the Asian markets for price surge.

- Propylene market has also been witnessing firmness in prices. FOB Korea values were assessed around USD 990/MT while CFR China values were assessed around USD 1060MT. With maintenance scheduled in the month of January more progression in values will take place in next few months in Asian markets.

- This week crude oil prices have followed up velocity. On Thursday Brent crude oil hit a more than three-year high breaking through the psychologically important $70 a barrel level for the first time since December 2014.

- On Thursday, closing crude values have increased. WTI on NYME closed at $63.80/bbl; prices have increased by $0.23/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.06/bbl in compared to last trading and was assessed around $69.26/bbl.

- Oil prices have been supported by stronger-than-expected demand fueled by worldwide economic growth, ongoing output limits by OPEC and Russia and a series of global events that have stoked geopolitical tension.

- Market analysts say it will be hard for oil prices to tack on gains from these levels. Robust global demand, OPEC output cuts and a series of geopolitical tensions have accelerated a rally that began in June.

$1 = Rs. 63.61

Import Custom Ex. Rate USD/ INR: 64.50

Export Custom Ex. Rate USD/ INR: 62.80