MEG Weekly Report 13 May 2017

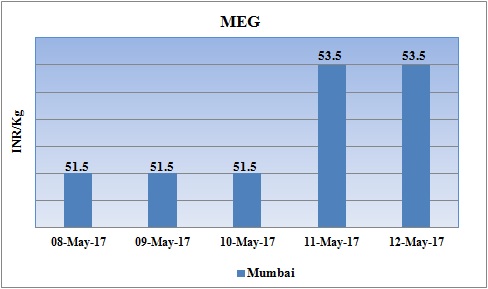

Weekly Price Trend: 08-05-2017 to 12-05-2017

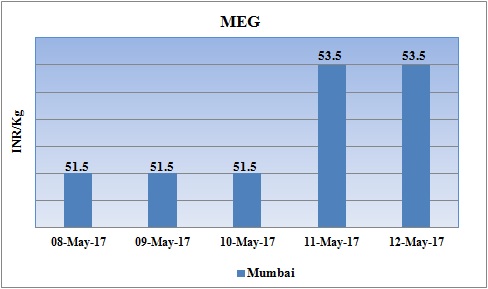

- The above given graph focuses on the MEG price trend from 8th May to 12th May 2017.

- Prices reduced slightly in the initials of the week. As the week proceeded increase in the domestic values were witnessed. Domestic prices were assessed at the level of Rs.53.5/Kg for bulk quantity with no change in compare to last week’s closing values.

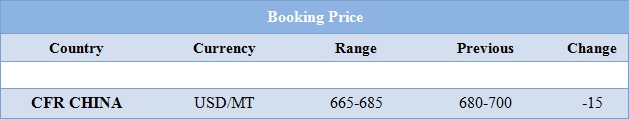

Booking Scenario

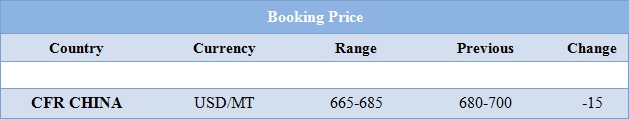

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained volatile for this week. Prices were assessed at the level of Rs.53.5/Kg for bulk quantity.

- CFR India prices were assessed in the range of USD 640-660/MTS. Prices reduced heavily for this week.

- CFR China values decreased by USD 15/MTS in compare to last week’s assessed values and were assessed in the range of USD 665-685/MT

- CFR SEA prices for MEG were assessed around USD 695/MT for this week. There has been slight reduction of USD 5 in compare to last week’s closing values. FOB Korea values for Ethylene was assessed around USD 1160/MTS while CFR China values for Ethylene were assessed around USD 1205/MTS.

- FOB Korea values for Propylene was assessed around USD 790/MTS while CFR China values were assessed around USD 805/MTS.

- This week oil prices pushed up with minute plunge. Last week U.S. crude stockpiles posted their biggest drawdown since December as imports dropped sharply, while inventories of refined products also fell, helping boost oil prices that have been weighed down by concerns about oversupply.

- On Wednesday oil prices began looking higher after a string of positive data on oil stocks in the US helped to improve the market mood.

- As per reports, drop in the prices was seen which was beyond expectation and fuel stocks received the initial bullish attention. Adding to the positive tone was the reduction in imports.

- According to report a large part of the excess supply extended which in turn led to the shortage in the storage facilities.

- However, continued rebalancing in the oil market by year-end will require the collective efforts of all oil producers to increase market stability, not only for the benefit of the individual countries, but also for the general prosperity of the world economy, As per report.

- OPEC is due to meet later this month in the hope of striking a second deal to secure a year of production cuts. The twelve member states will be joined by Russia, but US production remains a concern.

- On Thursday, closing crude values have increased.WTI on NYME closed at $47.83/bbl, prices have increased by $0.50/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.55/bbl in compared to last trading and was assessed around $50.77/bbl.

$1 = Rs. 64.30

Import Custom Ex. Rate USD/ INR: 65.10

Export Custom Ex. Rate USD/ INR: 63.40