MEG Weekly Report 14 April 2018

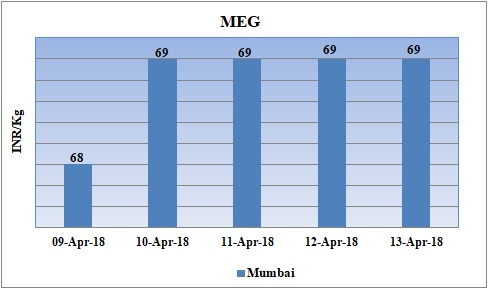

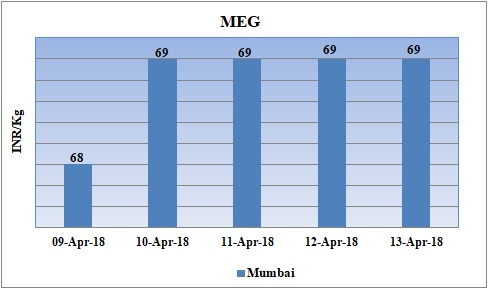

Weekly Price Trend: 09-04-2018 to 13-04-2018

- The above given graph focuses on the MEG price trend from 9th April to 13th April 2018.

- Prices remained vulnerable for this week. Domestic prices were assessed at the level of Rs.69/Kg for bulk quantity.

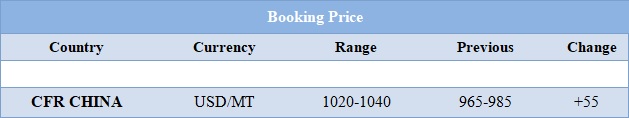

Booking Scenario

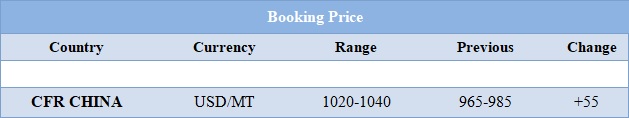

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained firm for bulk quantity. Prices were assessed at the level of Rs.69/Kg for bulk quantity.

- CFR China values were assessed around USD 1020-104/MT, increased by USD 55/MT in one week. CFR South East Asia assessed around USD 1035/MT again increased by USD 55/MT in last one week.

- FOB Korea values for Ethylene were assessed around USD 1385/MT, increased by USD 10/MTS while CFR China values were assessed around USD 1365/MT, reduced by USD 10/MTS in one week.

- On other side Propylene market has also increased for this week. FOB Korea values were assessed around USD 1025/MT while CFR China values were assessed around USD 1060MT.

- India’s Haldia Petrochemicals is planning to shut its petrochemical complex for maintenance turnaround. The unit will be shut down on 10 May for annual maintenance. The shutdown period is likely to last for 25 days. The unit has the production complex which is a naphtha-fed steam cracker, which has a design production capacity of 700,000 mt/year of ethylene and 350,000 mt/year of propylene. The cracker feeds a 101,000 mt/year butadiene extraction unit. Unit is based at West Bengal state of India.

- China based CNOOC Huizhou is likely to start MEG unit in the month of June. Unit is based at Guangdong in China and has the production capacity of 400 KT per year. The other Qianxi Coal Chemical to start MEG unit in the month of May or June. Unit is based at Guizhou in China and has the production capacity of 300 KT per year.

- China’s company Sinopec Zhenhai Refining and Chemical has announced its maintenance schedule for its naphtha cracker unit. The unit is likely to go off-stream in the second half of May for scheduled maintenance turnaround. The cracker has the production capacity of 1 million mt/year of ethylene, 550,000 mt/year of propylene and 180,000 mt/year of butadiene.

- Oil prices have escalated through the week but on Thursday prices have remained mixed. On Thursday, closing crude values have mixed. WTI on NYME closed at $67.07/bbl; prices have increased by $0.25/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.40/bbl in compared to last trading and was assessed around $72.02/bbl.

- Oil markets remained tense on Thursday on concerns over a military escalation in Syria, although prices were some way off Wednesday's late-2014 highs as bulging U.S. supplies weighed. A trade dispute between the United States and China also kept markets on edge.

- Crude oil prices settled at three-year highs amid ongoing expectations that geopolitical tensions in the Middle East could add a possible ‘fear premium’ to oil, while continued OPEC cuts supported sentiment.

- If the U.S. does indeed launch missiles at Syria, this would heighten risk and likely at once push crude oil higher and depress equities further.

$1 = Rs. 65.20

Import Custom Ex. Rate USD/ INR: 65.90

Export Custom Ex. Rate USD/ INR: 64.20