MEG Weekly Report 14 July 2018

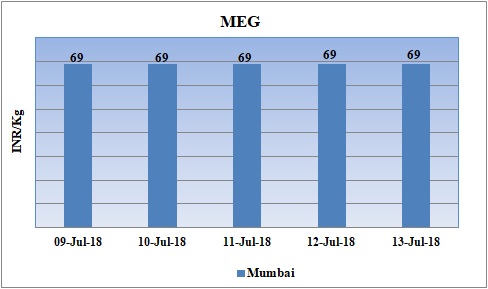

Weekly Price Trend: 09-07-2018 to 13-07-2018

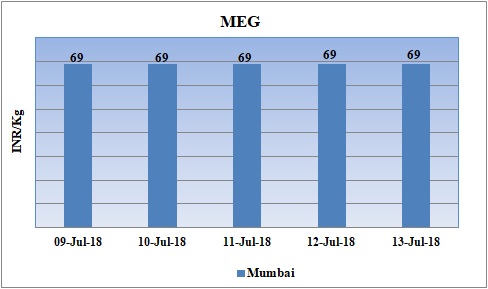

- The above given graph focuses on the MEG price trend from 9th July to 13th July 2018.

- Prices remained soft-to-stable for this week. Domestic prices were assessed at the level of Rs.69/Kg for bulk quantity.

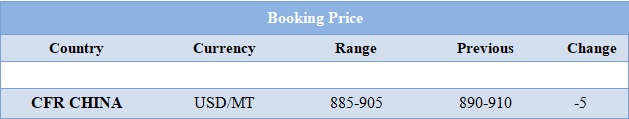

Booking Scenario

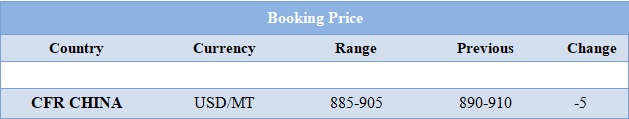

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained soft for bulk quantity. Prices were assessed at the level of Rs.69 /Kg for bulk quantity.

- CFR China values were assessed around USD 885-905/MT, slightly reduced by USD 5/MT for this week. CFR South East Asia assessed around USD 930/MT.

- FOB Korea values for Ethylene were assessed around USD 1340/MT, while CFR China values were assessed around USD 1390/MT and CFR South East Asia values were assessed around USD 1275/MT.

- On other side Propylene market increased for this week. FOB Korea values were assessed around USD 1030/MT while CFR China values were assessed around USD 1040/MT.

- Taiwan based Formosa has made an important announcement regarding the restart of its naphtha fed steam cracker unit. The steam cracker will be restarted by end of this week.

- The steam cracker based at Mailiao in Taiwan has the production capacity to produce 700,000 mt/year of ethylene, 350,000 mt/year of propylene and 109,000 mt/year of butadiene.

- The company has three naphtha-fed steam crackers in Mailiao. The No. 2 cracker is able to produce 1.03 million mt/year of ethylene, 515,000 mt/year of propylene and 162,000 mt/year of butadiene, while the No. 3 unit is capable of producing 1.2 million mt/year of ethylene, 600,000 mt/year of propylene and 180,000 mt/year of butadiene.

- In the latest round of tariffs imposed by US on China will include many petrochemical products. The list of $200 billion in Chinese goods disclosed this week would be subject to a 10% tariff if implemented amid growing trade tensions between the US and China.

- The $200 billion list includes ethylene, propylene, butadiene, chlorine and caustic soda, benzene, xylene, toluene and ethylene glycol.

- Prices in Indian market are likely to remain weak as there are heavy rains in Mumbai and western part of India. There is a huge impact of monsoon season on the demand for majority of petchem products.

- This week crude oil prices have followed mixed trend. On Thursday oil prices steadied, after the International Energy Agency's warned that the world's oil supply cushion "might be stretched to the limit" due to production losses in several different countries.

- Brent prices rallied on Thursday, recouping some ground following sharp losses the previous session after Libya said it would resume oil exports. Brent crude oil gained 59 cents a barrel to trade at $74/bbl. On Wednesday, the global benchmark slumped $5.46, its biggest one-day fall in two years.

- On Thursday, closing crude values have remained mixed. WTI on NYME closed at $70.33/bbl; prices have decreased by $0.05/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $1.05/bbl in compare to last closing price and was assessed around $74.45/bbl.

$1 = Rs. 68.52

Import Custom Ex. Rate USD/ INR: 69.70

Export Custom Ex. Rate USD/ INR: 68.00