MEG Weekly Report 15 July 2017

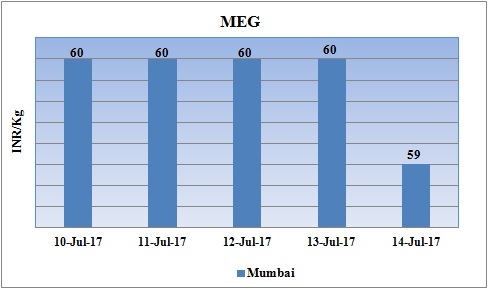

Weekly Price Trend: 10-07-2017 to 14-07-2017

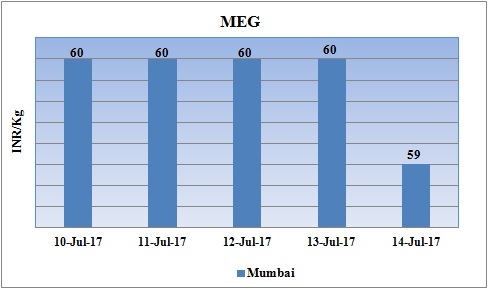

- The above given graph focuses on the MEG price trend from 10th July to 14th July 2017.

- Prices remained decreased for this week. Domestic prices were assessed at the level of Rs.59/Kg for bulk quantity with slight change in compare to last week’s closing values.

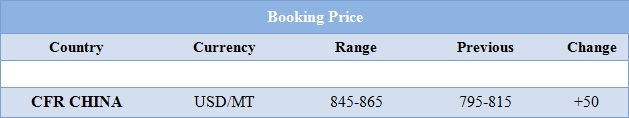

Booking Scenario

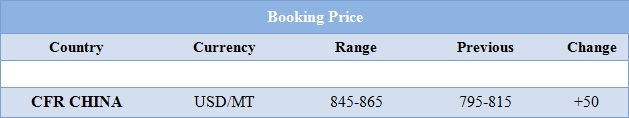

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices reduced slightly. Prices were assessed at the level of Rs.59/Kg for bulk quantity.

- CFR China values on contrary increased heavily by USD 50/MTS in compare to last week’s assessed values and were assessed in the range of USD 845-865/MT

- CFR SEA prices for MEG were assessed around USD 850/MT for this week increased by USD 50/MTS in one week. FOB Korea values for Ethylene was assessed around USD 890/MTS remained unchanged while CFR China values for Ethylene were assessed around USD 925/MTS.

- India’s leading petrochemical firm Reliance Industries Ltd (RIL) will bring its new MEG unit on-stream in the month of July end. The unit is based at Jamnagar in Gujarat. The production capacity of unit is 7,50,000 mt/year. According to sources,” annum, IOCL has an output capacity of 360,000 mt/annum and IGL has an output capacity of 300,000 mt/annum."

- FOB Korea values for Propylene was assessed around USD 845/MTS while CFR China values were assessed around USD 860/MTS.

- This week Crude oil prices followed up an positive trend as Saudi Arabia is going to cut exports of crude oil to the United States, but this is going to be a short-term effect on the market as the United States becomes much more energy independent.

- On Thursday, closing crude values have increased.WTI on NYME closed at $46.08/bbl, prices have increased by $0.59/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.68/bbl in compared to last trading and was assessed around $48.42/bbl.

- As per market source, the oil market could stay oversupplied for longer than expected due to rising production and limited output cuts by some OPEC exporters. Rising consumption in Germany and the United States was helping boost oil demand. OPEC said its production rose by 393,000 barrels per day in June to 32.611 million bpd.

$1 = Rs. 64.45

Import Custom Ex. Rate USD/ INR: 65.65

Export Custom Ex. Rate USD/ INR: 63.95