MEG Weekly Report 16 Sep 2017

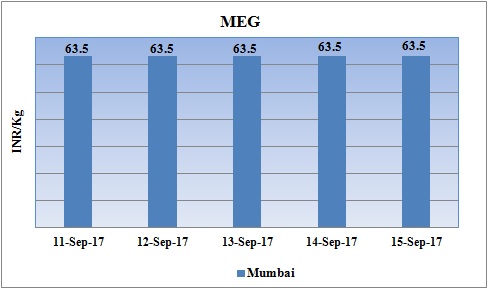

Weekly Price Trend: 11-09-2017 to 15-09-2017

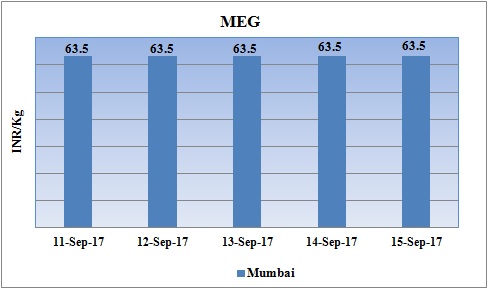

- The above given graph focuses on the MEG price trend from 11th Sept to 15th Sept 2017.

- Prices increased significantly for this week. Domestic prices were assessed at the level of Rs.63.5/Kg for bulk quantity, remained unchanged for bulk quantity in compare to last week’s closing values.

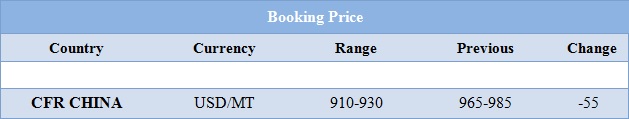

Booking Scenario

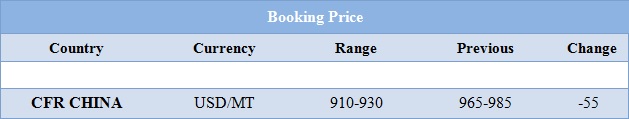

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices witnessed a rise in values. Prices were assessed at the level of Rs.63.5/Kg for bulk quantity.

- CFR China values were assessed around USD 910-930/MT reduced by USD 55/MT in compare to last week’s assessed values.

- CFR China Ethylene values were assessed around USD 1290/MT reduced by USD 5/MT in compare to last week’s closing values. While FOB Korea values were assessed around USD 1245/MT, slight fall of USD 10/MT in compare to last week’s closing values.

- MEGlobal the wholly owned subsidiary of Kuwait’s Petrochemicals Equate Petrochemical will shut down its MEG unit for maintenance turnaround. Equate will be conducting a major turnaround of its MEG unit in the third quarter of 2017. Equate's MEG capacity in Kuwait has a nameplate capacity of 1.2 million mt/year. As a result there will be loss in the production of 70,000 – 1,00,000 mt/year. Due to this turnaround schedule the company will shelve its supply to Middle East, Turkey, India and Pakistan.

- This week there has been significant hike in crude values. Prices has reached too its highest level since April in this year. Crude values rose above $ 50/barrel for the first time. Both the contracts have increased by more than 19% since /June.

- Many fundamental factors are helping to support oil prices at this moment. Short supply, stronger demand along with ongoing restrictions from OPEC and Russia are few major reasons for the surge in oil prices.

- This week has been highly positive for crude values in international market. On Thursday closing, crude values gained in the international market.WTI on NYME closed at $49.89/bbl, prices improved by 0.59 in compared to last closing prices. While, Brent on Inter Continental Exchange was assessed at the rate of $55.47/bbl increased by 0.31/bbl on Wednesday.

$1 = Rs. 64.07

Import Custom Ex. Rate USD/ INR: 64.90

Export Custom Ex. Rate USD/ INR: 63.25