MEG Weekly Report 17 March 2018

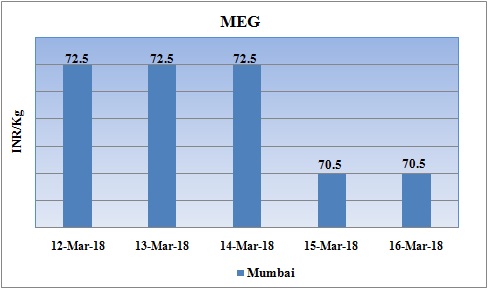

Weekly Price Trend: 12-03-2018 to 16-03-2018

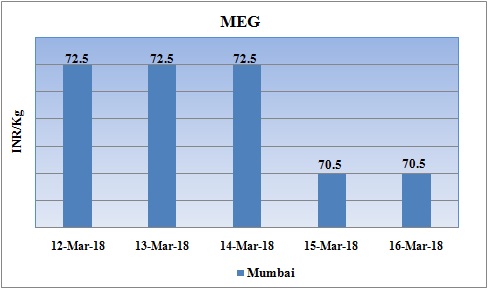

- The above given graph focuses on the MEG price trend from 12th March to 16th March to 2018.

- Prices remained variable for this week. Domestic prices were assessed at the level of Rs.70.5/Kg for bulk quantity.

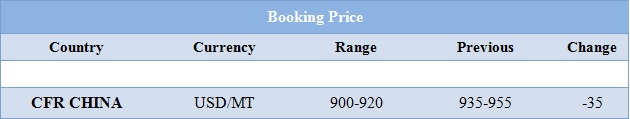

Booking Scenario

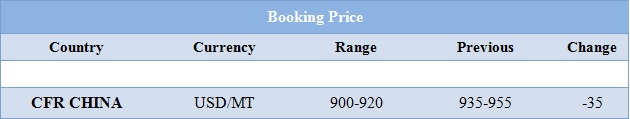

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained reduced for bulk quantity. Prices were assessed at the level of Rs.70.5/Kg for bulk quantity.

- CFR China values were assessed around USD 900-920MT, reduced by USD 35/MT in one week.

- CFR South East Asia assessed around USD 915/MT again reduced by USD 35/MT in last two weeks.

- On contrary, FOB Korea values for Ethylene were assessed around USD 1250/MT, increased by USD 75/MTS while CFR China values were assessed around USD 1340/MT, increased by USD 80/MTS in one week.

- Propylene market has also reduced for this week. FOB Korea values were assessed around USD 1015/MT while CFR China values were assessed around USD 1065MT. With maintenance scheduled in the month of January more progression in values will take place in next few months in Asian market.

- Jubail United Petrochemical is planning to shut its MEH unit for maintenance turnaround. The unit is likely to go off-stream in the last week of March. The unit is expected to remain off-stream for around 3 weeks and may resume production in the mid of April. Unit is based at Al Jubail in Saudi Arabia and has the production capacity of 7,00,000 mt/year.

- Tosoh Corp has shut down its cracker for maintenance turnaround. The cracker was shut down last week as per annual maintenance schedule. The unit is likely to remain off-stream for around 40 days.

- Unit is based at Yokkaichi in Japan and has the production capacity of 5,27,000 mt/year. Show Denka has shut down its Ethylene cracker maintenance turnaround. The unit was shut down last week as per annual maintenance schedule. The unit is likely to remain off-stream for around 40 days. Unit is based at Oita in Japan and has the production capacity of Ethylene around 6,90,000 mt/year and Propylene around 4,25,000 mt/year.

- Market sentiments in current scenario continue to remain uncertain. Experts believed that after Lunar holidays market prices will soar up. On contrary there has been constant weakening of prices in China market. Demand from end user has pulled down heavily in turn leading to weakening of prices. This slowdown is expected to last for few more weeks.

- This week oil prices have followed volatile inclination. Oil prices edged higher in choppy trade on Thursday, supported by a pickup in equity markets but pressured by expectations that crude supply will exceed demand later this year.

- On Thursday, closing crude values have increased. WTI on NYME closed at $61.19/bbl; prices have increased by $0.23/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.23/bbl in compared to last trading and was assessed around $65.12/bbl.

- Rising global oil demand, along with supply constraints from the OPEC, has helped keep oil above $60 a barrel.

- As per report, global oil demand is expected to pick up this year but supply is growing at a faster pace, leading to a rise in inventories in the first quarter of 2018. U.S. oil output hit a record 10.38 million barrels per day. OPEC expects to lose market share as output from non-OPEC nations soars.

$1 = Rs. 64.93

Import Custom Ex. Rate USD/ INR: 65.80

Export Custom Ex. Rate USD/ INR: 64.15