MEG Weekly Report 18 Nov 2017

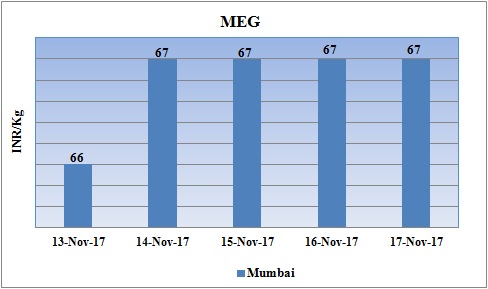

Weekly Price Trend: 13-11-2017 to 17-11-2017

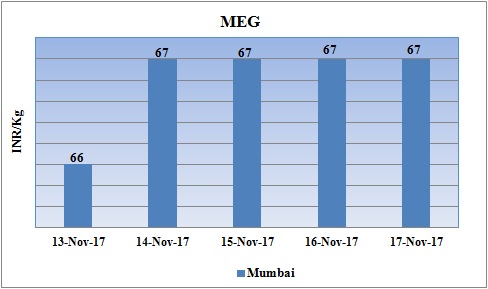

- The above given graph focuses on the MEG price trend from 13th Nov to 17th Nov 2017.

- Prices slightly increased for this week. Domestic prices were assessed at the level of Rs.67/Kg with no changes in compare to last week’s closing values.

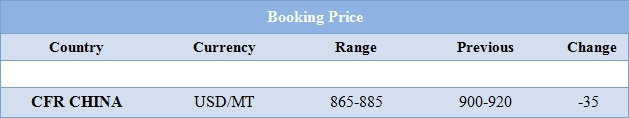

Booking Scenario

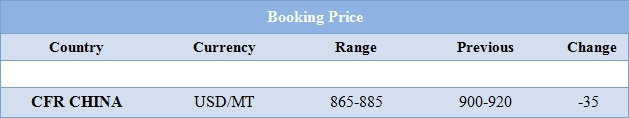

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices increased slightly with a rise of Rs.1/Kg for bulk quantity. Prices were assessed at the level of Rs.67/Kg for bulk quantity.

- CFR China values were assessed around USD 865-885/MT, reduced by USD 35/MTS in compare to last week’s assessed values.

- CFR China Ethylene values were assessed around USD 1295/MT while FOB Korea values were assessed around USD 1250/MT.

- CFR China Propylene values were assessed around USD 930/MT while FOB Korea values were assessed around USD 875/MT.

- US Market has been quite weak for MEG values. All the major units in US are operating at their full rates post disastrous Harvey. With abundant production, the domestic market are unable to consume the ample supply. As a result manufacturers are diverting their supply towards Asian market.

- The major chunk of MEG is supplied to China market. With onset of winter season in all major Asian countries demand for MEG will see a boost. Experts do believe market may become slightly bullish in next month.

- Asian markets are also under satisfactory level with supply of MEG as there has been constant shut down and restart of major MEG manufacturing units in Middle East and gulf.

- Market trends remained stable to positive for this week. Market will see an upsurge in next few weeks as political tension Saudi Arabia has been clinching the petrochemical market all over the world.

- There has been continuous hike in exchange rates for India as well. This in turn tightens the market conditions for importers.

- There has been a constant worry from China market as government over there has become really strict with petrochemical industry regarding pollution and environmental issues. Many units under shut down are unable to go on-stream due to denial from government authorities.

$1 = Rs. 67.63

Import Custom Ex. Rate USD/ INR: 66.20

Export Custom Ex. Rate USD/ INR: 64.50