MEG Weekly Report 20 May 2017

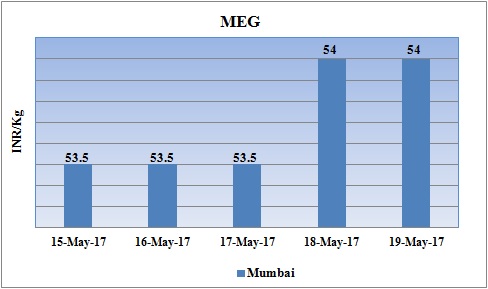

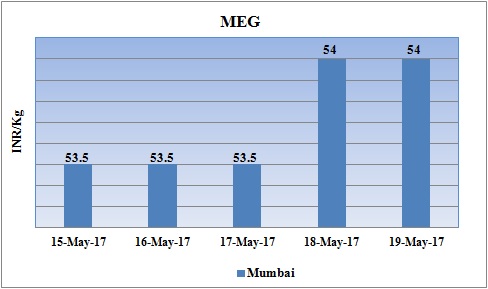

Weekly Price Trend: 15-05-2017 to 19-05-2017

- The above given graph focuses on the MEG price trend from 15th May to 19th May 2017.

- Prices reduced slightly in the initials of the week. As the week proceeded increase in the domestic values were witnessed. Domestic prices were assessed at the level of Rs.54/Kg for bulk quantity with no change in compare to last week’s closing values.

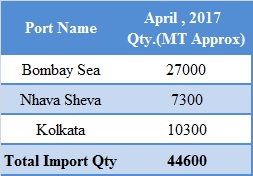

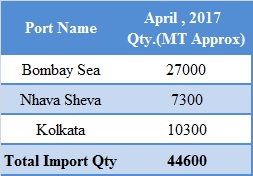

Total import at various ports in the month of April 2017

The above chart depicts the import of MEG at various ports of India in the month of April 2017.

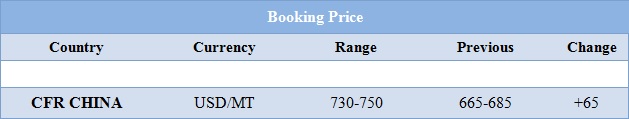

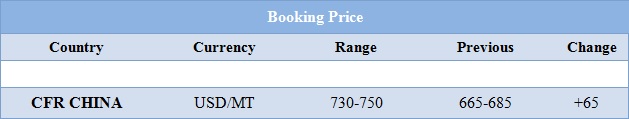

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained volatile for this week. Prices were assessed at the level of Rs.53.5/Kg for bulk quantity.

- CFR India prices were assessed in the range of USD 740-750/MTS. Prices increased heavily for this week.

- CFR China values increased by USD 65/MTS in compare to last week’s assessed values and were assessed in the range of USD 730-750/MT

- CFR SEA prices for MEG were assessed around USD 745/MT for this week. There has been heavy rise of USD 65/MTS in compare to last week’s closing values. FOB Korea values for Ethylene was assessed around USD 1150/MTS while CFR China values for Ethylene were assessed around USD 1195/MTS.

- FOB Korea values for Propylene was assessed around USD 805/MTS while CFR China values were assessed around USD 850/MTS.

- This week overall crude oil prices plunged with little instability. Recent announcements by Russia and Saudi Arabia have helped oil prices to recover and several analysts have highlighted the energy sector as a potential play for investors.

- According to recent reports, Russia and Saudi Arabia has announced about the cut in supply of oil to be extended for another nine months i.e till arch 2018.are likely tp discuss this matter in their next meeting.

- Experts from tm the oil market believe that Russia and other major producers could help drive oil prices back to $60 per barrel or more with a new production deal, but again that would be a green signal for U.S. shale drillers. This drive even could bring the oil to range in $60 oil the end of the year, but the gains are not expected to spike much higher.

- On Thursday, closing crude values have increased.WTI on NYME closed at $49.35/bbl, prices have increased by $0.28/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.30/bbl in compared to last trading and was assessed around $52.51/bbl.

$1 = Rs. 64.64

Import Custom Ex. Rate USD/ INR: 65.30

Export Custom Ex. Rate USD/ INR: 63.60