MEG Weekly Report 24 June 2017

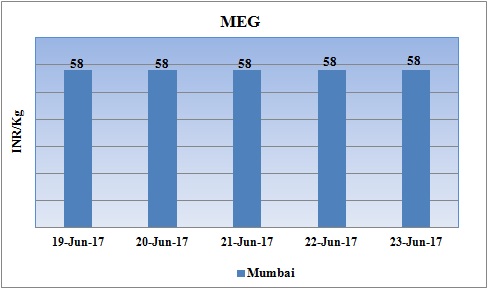

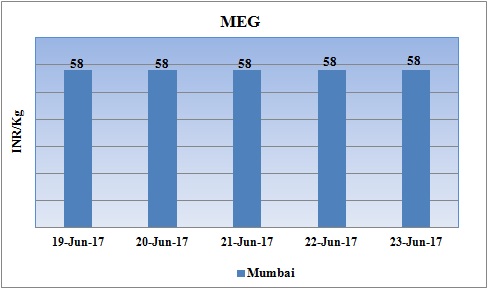

Weekly Price Trend: 19-06-2017 to 23-06-2017

- The above given graph focuses on the MEG price trend from 19th June to 23rd June 2017.

- Prices remained unchanged for this week. Domestic prices were assessed at the level of Rs.58/Kg for bulk quantity with no change ins compare to last week’s closing values.

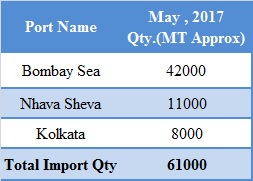

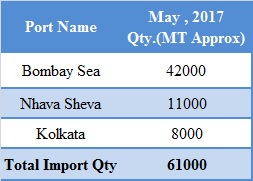

Total import at various ports in the month of May 2017

The above chart depicts the import of MEG at various ports of India in the month of May 2017.

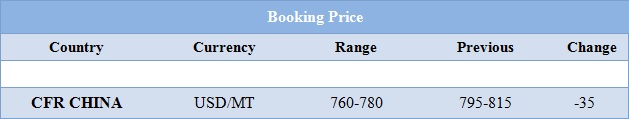

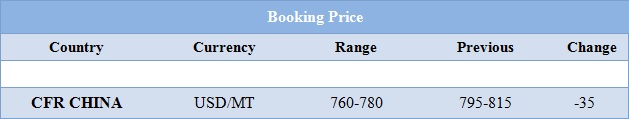

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONALs

- This week domestic prices remained unchanged week. Prices were assessed at the level of Rs.58/Kg for bulk quantity.

- CFR China values decreased by USD 35/MTS in compare to last week’s assessed values and were assessed in the range of USD 760-780/MT

- CFR SEA prices for MEG were assessed around USD 775/MT for this week. FOB Korea values for Ethylene was assessed around USD 900/MTS while CFR China values for Ethylene were assessed around USD 955/MTS.

- FOB Korea values for Propylene was assessed around USD 825/MTS while CFR China values were assessed around USD 845/MTS.

- This week oil prices followed mixed trend. The oil market posted its worst performance in the first six months in last two decades effectively signaling its refusal to accept the effectiveness of the OPEC statement and its desire for further production cuts.

- As per report, OPEC and Russia tried to stabilize prices with cuts at around $50-$60 per barrel, but this week Brent prices fell toward $44 per barrel on persistent oversupply worries.

- On Thursday Crude oil rose moderately following a Wednesday in which the commodity bottomed just above $42 per barrel.

- On Thursday, closing crude values have increased.WTI on NYME closed at $42.74/bbl, prices have increased by $0.21/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.40/bbl in compared to last trading and was assessed around $45.22/bbl.

- OPEC ministers and officials have said the cartel would not rush to deepen production cuts from the current four percent to arrest the price decline. They said the group would rather wait until existing joint cuts with non-OPEC Russia finally result in a global stocks decline during the third quarter when demand for crude oil is usually strong.

- OPEC and Russian sources also told that there were few signs the group is preparing any extraordinary action ahead of a joint ministerial monitoring committee meeting in Russia at the end of July.

$1 = Rs. 64.52

Import Custom Ex. Rate USD/ INR: 65.15

Export Custom Ex. Rate USD/ INR: 63.50