MEG Weekly Report 24 March 2018

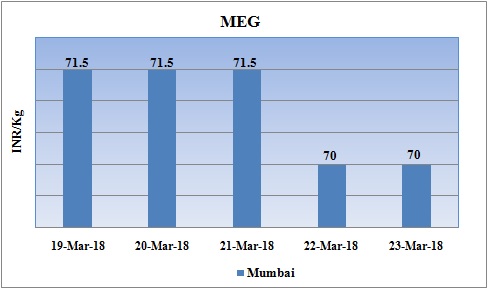

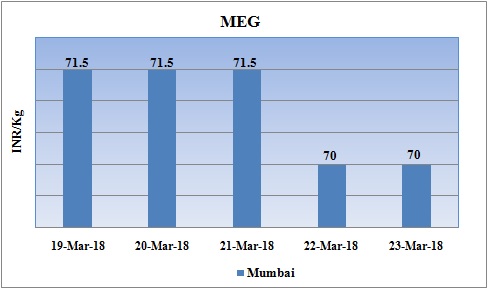

Weekly Price Trend: 19-03-2018 to 23-03-2018

- The above given graph focuses on the MEG price trend from 19th March to 23rd March to 2018.

- Prices remained variable for this week. Domestic prices were assessed at the level of Rs.70/Kg for bulk quantity.

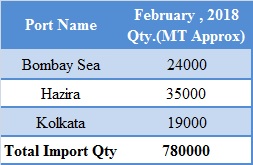

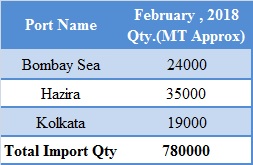

Total import at various ports in the month of February 2018-MEG

The above chart depicts the import of MEG at various port in the month of February 2018

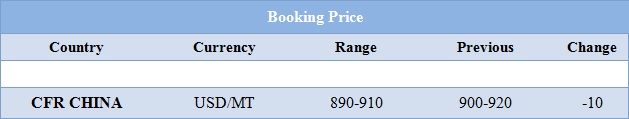

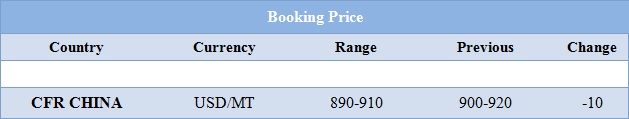

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained reduced for bulk quantity. Prices were assessed at the level of Rs.70.5/Kg for bulk quantity.

- CFR China values were assessed around USD 890-910MT, reduced by USD 10/MT in one week.

- CFR South East Asia assessed around USD 905/MT again reduced by USD 10/MT in last two weeks.

- On contrary, FOB Korea values for Ethylene were assessed around USD 1350/MT, increased by USD 100/MTS while CFR China values were assessed around USD 1360/MT, increased by USD 20/MTS in one week.

- Propylene market has also reduced for this week. FOB Korea values were assessed around USD 1010/MT while CFR China values were assessed around USD 1065MT. With maintenance scheduled in the month of January more progression in values will take place in next few months in Asian market.

- Demand sentiments in China market has improved on back of strong demand from Polyester industry. To cater this growing demand from Polyester industry many new MEG manufacturing units will come into existence by 2020. Experts fear that new start up may lead to oversupply of the chemical.

- Formosa Petrochemicals Corp has shut down its cracker no1 due to sudden technical fault. The unit was likely to remain off-stream for one or two days.

- The unit is based at Mailiao in Taiwan and has the manufacturing capacity of Ethylene around 700,000 mt/year, propylene production capacity of 350,000 mt/year and butadiene production capacity of 109,000 mt/year.

- Petkim is planning to restart its naphtha cracker after maintenance. The unit was restarted after an unplanned shutdown. Earlier the unit was shut down due to technical fault in the first week of March 2018.

- An important decision has been taken by the Reserve Bank of India (RBI) to ban the lending credit will have an adverse impact on chemical importers in the country. The recent scam in PNB and many other defaulters has hit hard to the Indian banking system. The central banking authority has now decided to put a weight on LC and LOU. The implementation of this law will come in April month. This will in turn affect the GDP growth of the country. An LOU is generally used to fund imports and to avail short-term credit. It is also an undertaking by the issuing bank to pay in case of default by the one on whose behalf it was issued. The Indian importers believe that this ban will have an adverse impact on traders as import cost will shoot up. The most prominent chemicals are Phenol and acetone and other solvents are likely to witness a severe hike in values.

- This week crude oil prices have followed little volatility while increased through the week. On Thursday oil prices fell as investors booked profits after this week's rally, but losses were limited by the continuing efforts of OPEC and its allies to curb supplies.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $64.30/bbl; prices have decreased by $0.87/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.56/bbl in compared to last trading and was assessed around $68.91/bbl. Recently, market players continue to see fragility in the oil market.

- Profit-taking risks still appear large, strong output growth challenges the market-tightening narrative and the supply deals overdue transitioning remains blanketed in uncertainty.

$1 = Rs. 65.00

Import Custom Ex. Rate USD/ INR: 65.80

Export Custom Ex. Rate USD/ INR: 64.15