MEG Weekly Report 25 August 2018

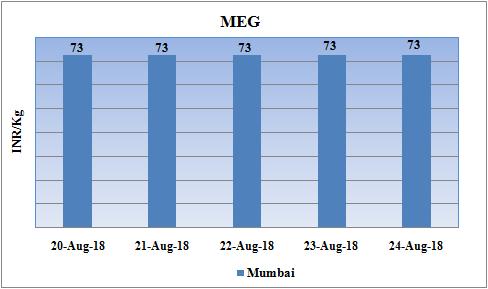

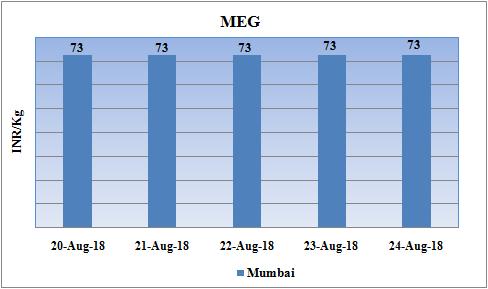

Weekly Price Trend: 20-08-2018 to 24-08-2018

- The above given graph focuses on the MEG price trend from 20th August to 24th August 2018.

- Prices remained stable-to-firm for this week. Domestic prices were assessed at the level of Rs.73/Kg for bulk quantity.

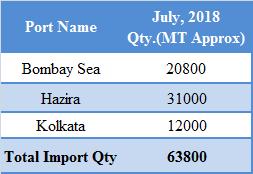

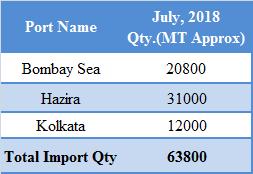

Total MEG import t various ports of India in July 2018

The above chart depicts the imports of MEG at various ports of India in July 2018

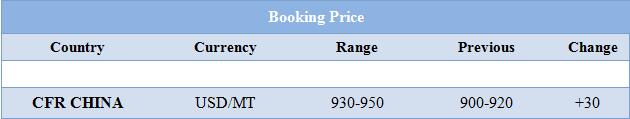

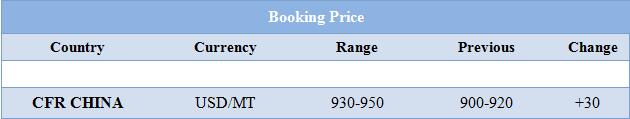

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices remained firm for bulk quantity. Prices were assessed at the level of Rs.73 /Kg for bulk quantity.

- CFR China values were assessed around USD 930-950/MT, significantly increased by USD 30/ MTS for this week. CFR South East Asia assessed around USD 960/MT.

- FOB Korea values for Ethylene were assessed around USD 1375/MT, while CFR China values were assessed around USD 1395/MT and CFR South East Asia values were assessed around USD 1255/MT.

- On other side Propylene market increased for this week. FOB Korea values were assessed around USD 1095/MT while CFR China values were assessed around USD 1145/MT.

- There has been significant hike in Ethylene and Propylene values in China market.

- The fresh list of goods on which China will impose import tariffs from US include MEG. The tariff charges are likely to be around 25% and will be applicable by 23rd August.

- Experts on other side believe that this will not have a major impact on China as it imports only 2% of total MEG import from US. Further new plants will go on-stream which will further increase the capacity and lower the imports.

- At present MEG production faces short term challenges to divert the cargoes to other locations, while in the middle-to-long term, changes in trade flows will be inevitable to cater to the new facilities coming on board in the US. The short-term impact, is likely to be limited for China given that US is not a major exporter of MEG to China but may present a missed opportunity and logistical issues for US producers.

- Cargoes from the US to China tend to be seasonal, occurring in spurts in periods when local demand or import demand from Europe is unable to absorb production volume in the US.

- US to China MEG imports rose 270% year-on-year, to 182,690 tonnes in 2017. This is about 7.9% of the total US nameplate capacity of MEG. The US-China trade war has now escalated to a new level as a new round of tariffs affecting $16bn worth of imports, including petrochemicals, took effect at midday in Asia on Thursday, raising the total value of affected goods to $50bn on each side. The second wave of US tariffs on Chinese imports is being implemented less than two months since the first salvo on 6 July, and just as trade negotiations between the two countries were revived in Washington.

- In a statement issued on Thursday noon, China’s Ministry of Commerce said that the US move is a violation of World Trade Organisation (WTO) rules.“China firmly opposes this and has to continue to make the necessary counterattack," it said.

- The scheduled 22-23 August meeting between US treasury undersecretary for international affairs David Malpass and Chinese vice commerce minister Wang Shouwen initially raised hopes of a resolution to the ongoing trade spat between the world’s two biggest economies.

$1 = Rs. 69.91

Import Custom Ex. Rate USD/ INR: 71.10

Export Custom Ex. Rate USD/ INR: 69.40