MEG Weekly Report 25 Nov 2017

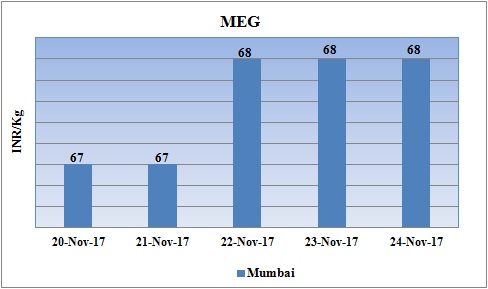

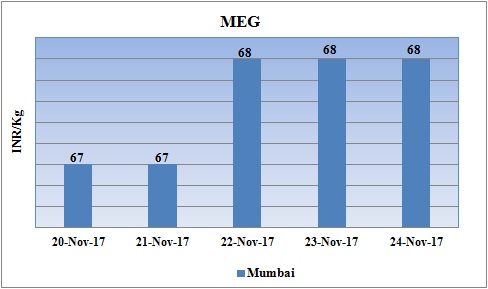

Weekly Price Trend: 20-11-2017 to 24-11-2017

- The above given graph focuses on the MEG price trend from 20th Nov to 24th Nov 2017.

- Prices slightly increased for this week. Domestic prices were assessed at the level of Rs.68/Kg with an hike if Re 1/Kg in compare to last week’s closing values.

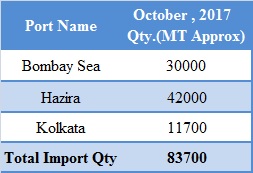

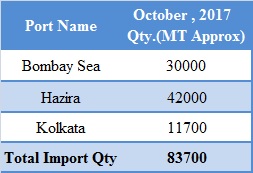

Total import at various ports in the month of October 2017

The above chart depicts the import of MEG at various ports of India in the month of October 2017.

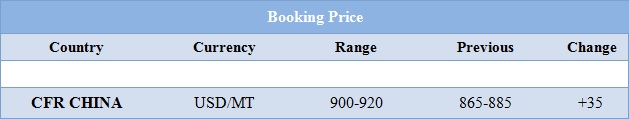

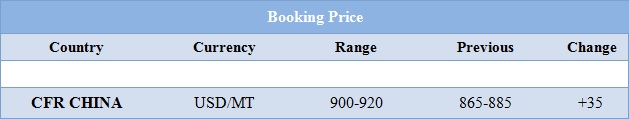

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONAL

- This week domestic prices increased slightly with a rise of Rs.1/Kg for bulk quantity. Prices were assessed at the level of Rs.68/Kg for bulk quantity.

- CFR China values were assessed around USD 900-920/MT, increased by USD 35/MTS in compare to last week’s assessed values.

- CFR China Ethylene values were assessed around USD 1290/MT while FOB Korea values were assessed around USD 1240/MT.

- CFR China Propylene values were assessed around USD 945/MT while FOB Korea values were assessed around USD 895/MT.

- The major chunk of MEG is supplied to China market from US. With onset of winter season in all major Asian countries demand for MEG will see a boost. Experts do believe market may become slightly bullish in next month.

- Asian markets are also under satisfactory level with supply of MEG as there has been constant shut down and restart of major MEG manufacturing units in Middle East and gulf.

- There has been huge cult in the petrochemical production output in China since January to October. On an average production growth has slowdown for 8.5 % to 3.9%. This has been due to extra consciousness of communist government of China in environmental issues. The quality of air has been regarded as worst in Chin since past few years. To overcome such issues the government has decided to put an cult on the petchem production. The Beijing-Tianjin-Hebei Region has been constantly monitored by the government.

- Industry sources expect the environmental measures to be adopted in the eastern and southern parts of China as well, and could mean a further curtailment to the country's overall petrochemical supply that will consequently drive up prices.

- There “is likely to be significant disruption to existing chemicals’ capacity” amid China’s environmental protection campaign.

$1 = Rs. 67.40

Import Custom Ex. Rate USD/ INR: 66.20

Export Custom Ex. Rate USD/ INR: 64.50