MEG Weekly Report 30 Dec 2017

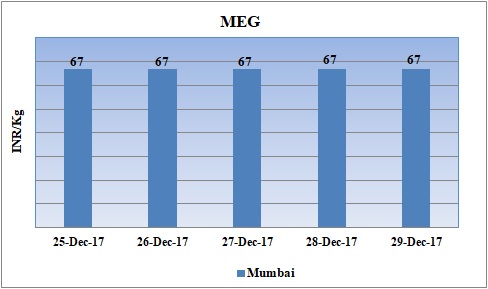

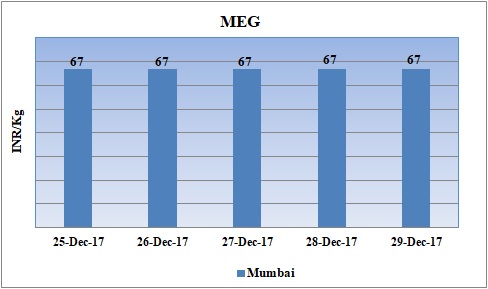

Weekly Price Trend: 25-12-2017 to 29-12-2017

- The above given graph focuses on the MEG price trend from 25th Dec to 29th Dec 2017.

- Prices remained unchanged for this week. Domestic prices were assessed at the level of Rs.67/Kg for bulk quantity.

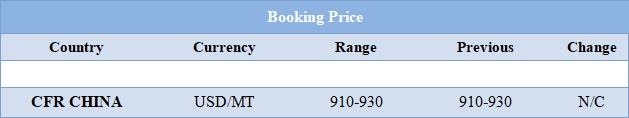

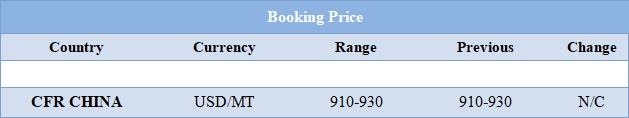

Booking Scenario

The above chart shows the international prices of MEG and its comparison from the previous prices.

INDIA & INTERNATIONALs

- This week domestic prices remained stable for bulk quantity. Prices were assessed at the level of Rs.67/Kg for bulk quantity.

- CFR China values were assessed around USD 910-9300MT, with no change in compare to last week’s assessed values.

- CFR North East Asia assessed around USD 1385/MT while CFR South East Asia were assessed around USD 1275/MT.

- Ethylene values have remained firm since last few weeks. Prices are expected to continue with this firmness for next few weeks as well.

- Strong buying sentiments coupled with healthy demand has been dominating the Asian markets for price surge.

- Propylene market has also been witnessing firmness in prices. With maintenance scheduled in the month of January more progression in values will take place in next few months in Asian markets.

- According to sources, there has been stringent supply of MEG in China market round the year 2017. This supply has been basically due to low inventory levels coupled with low demand from polyester sector. Many polyester units in China are planning to go for maintenance turnaround in few weeks.

- The supply remained tightened has pulled up the prices for MEG in China market. Traders may feel some relief in 2018 with starting of units and supply from Iran, US and gulf coast. Surge up in inventory will be felt only in February 2018. Most new units ate expected to go on-stream after Lunar vacation in China.

- To summarize, many traders believe that with all these possibilities supply for MEG is likely to get tightened up in the year2018.

- CPC Corp has shut down its no.4 cracker unit for maintenance turnaround. The cracker unit is likely to remain off-stream for around two months.

- Unit is based at Linyuan in Taiwan and has the manufacturing capacity to produce Ethylene around 3,80,000 mt/year and Propylene capacity around 1,93,000 mt/year.

- Yeochun NCC is planning to shut its naphtha cracker no2 for maintenance turnaround. The unit is likely to go off-stream in the month of February in 2018. The unit will remain off-stream for around two weeks. Unit is based at Yeosu in South Korea and has the manufacturing capacity Ethylene around 5,80,000 mt/year and Propylene around 2,70,00 mt/year.

$1 = Rs. 63.87

Import Custom Ex. Rate USD/ INR: 64.90

Export Custom Ex. Rate USD/ INR: 63.20