Melamine (Commercial) Weekly Report 29 April 2017

Weekly Price Trend: 24-04-2017 to 28-04-2017

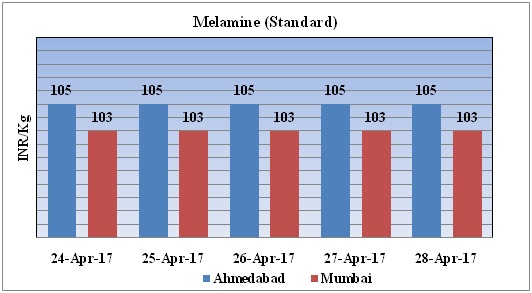

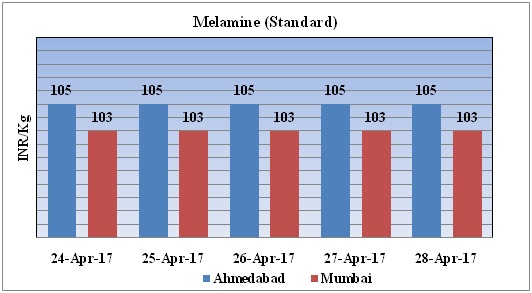

The above given graph focuses on the Melamine Standard price trend for the current week.

If we take a quick look at the above given weekly prices then it can be observed that the prices of Melamine (Standard) have remained firm and at the end of the week were assessed at the level of Rs. 105/Kg for Ahmedabad and Rs. 103/Kg for Mumbai port.

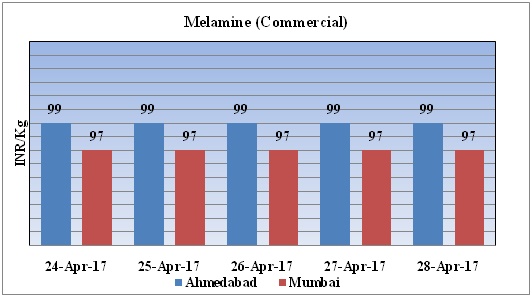

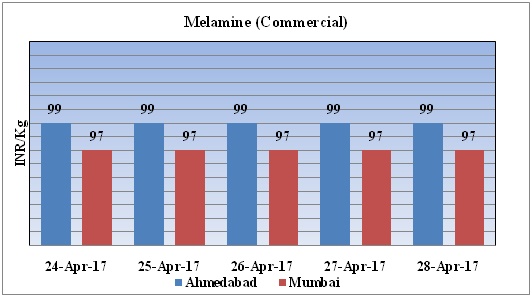

- The above given graph focuses on the Melamine Commercial price trend for the current week.

- If we take a quick look at the above given weekly prices then it can be observed that the prices of Melamine (Commercial) have remained firm in compare to previous week and at the end of the week were assessed at the level of Rs. 99/Kg for Ahmedabad and Rs. 97/Kg for Mumbai port.

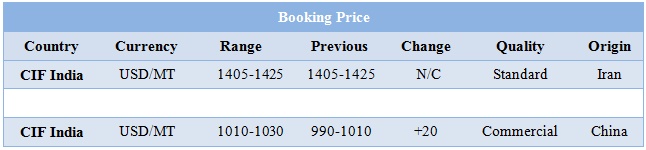

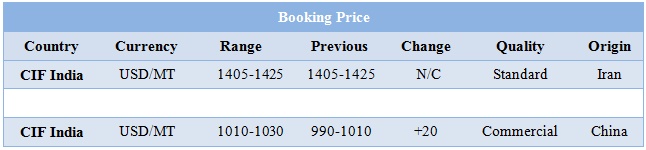

Booking Scenario

INDIA & INTERNATIONAL

- This week in domestic market prices of Melamine standard and commercial quality have remained firm while in compare to last week prices have plunged and at the end of this week price were assessed at the level of Rs. 105/Kg for Ahmedabad and Rs.103/kg for Mumbai ports and commercial quality were evaluated at Rs. 99/kg for Ahmedabad and Rs.97/kg for Mumbai.

- This week International Melamine standard prices have remained firm, while Melamine Commercial prices have increased by USD 20/mt.

- As per source report, presently melamine demand has been bearish market is moving with firm velocity.

- In Iran melamine market remained firm while in china melamine prices are escalating as in near term market will be shut for may holiday.

- As per source, China's March melamine exports remain the same on month.

- Some market players have said that US melamine market enters stronger demand quarter.

- India aims to become a urea exporter by 2021 as the South Asian nation has drawn up a 555 billion rupee plan to revive mothballed fertilizer plants and set up gas import and pipeline facilities in eastern India.

- The central government, with cash-rich coal, power and oil public sector units, will jointly invest around Rs 50,000 crore to revive closed fertilizer plants and set up new gas pipelines. All of which would make India self-sufficient in urea by 2020-21. Production was 24.5 mt in 2016-17.

$1 = Rs. 64.24

Import Custom Ex. Rate USD/ INR: 65.55

Export Custom Ex. Rate USD/ INR: 63.85