Methanol Weekly Report 06 Jan 2018

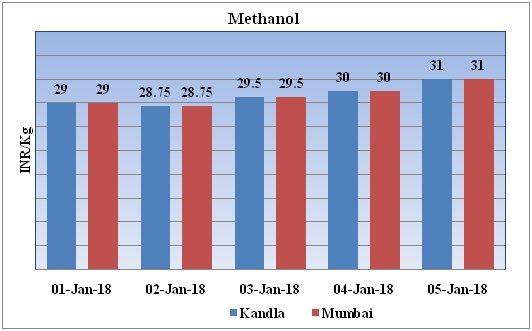

Weekly Price Trend: 01-01-2018 to 05-01-2018

The above graph focuses on the Methanol price trend for the current week. Prices have increased for this week. By the end of the week prices were assessed around Rs 31/Kg for Kandla and Rs 3

31/kg Mumbai ports.

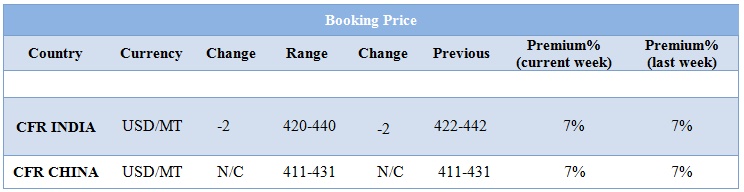

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed up trend and by the end of the week prices were evaluated at Rs 31/kg for Kandla and Rs 31/kg for Mumbai ports.

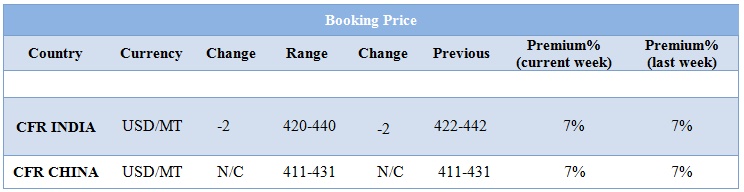

- CFR India prices were assessed in the range of USD 420-440/MTS. Prices have decreased by USD 2/mt in compares to previous week.

- Methanol markets may come across some resistance following a fall in Chinese prompt domestic prices.

- As per report, stock availability at eastern and southern Chinese ports were to be recovering slowly, at 341,600 mt, signaling an improving supply-side situation.

- It is anticipated that Asian MTBE market to go up in near term on stronger gasoline and energy markets, said by market players.

- The global methanol market is expected to reach a new high of 100.3 billion dollar in next 6 years. The demand is primarily driven by its application in adhesives, paints and laminates and plastic industry. The demand is growing at CAGR of 8.6% per annum.

- Increase in R&D activities for the usage of methanol as an alternative to gasoline products for vehicles is projected to drive the demand for methanol.

- India is now focusing on usage of Methanol as fuel in vehicles due to severs pollution. With this rising demand and usage the requirement for methanol is likely to see new highs in near future.

- Canada based Methanex has announced its ACPC for the month of January 2018. It has increased its contract prices for the month January by USD 40/MTS. Asian Contract prices are posted at USD 470/MTS. Prices posted for the region of Europe around Euro 380/MT, increased by USD 50/MT for this month.

- This week oil prices have remained little volatile but overall closed on higher note. On Thursday U.S. crude oil prices rise to the highest level in 2½ years as markets tightening amid tensions in Iran and due to ongoing OPEC-led production cuts.

- On Thursday, closing crude values have increased. WTI on NYME closed at $62.01/bbl; prices have increased by $0.38/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.23/bbl in compared to last trading and was assessed around $68.07/bbl.

- As per market analyst, the market is getting more bullish on oil as inventory levels get closer to the five-year average. Geopolitical uncertainty in Iran, OPEC's third largest producer, is also helping to support the price as citizens are again protesting the government.

$1 = Rs. 63.37

Import Custom Ex. Rate USD/ INR: 64.50

Export Custom Ex. Rate USD/ INR: 62.80