Methanol Weekly Report 06 May 2017

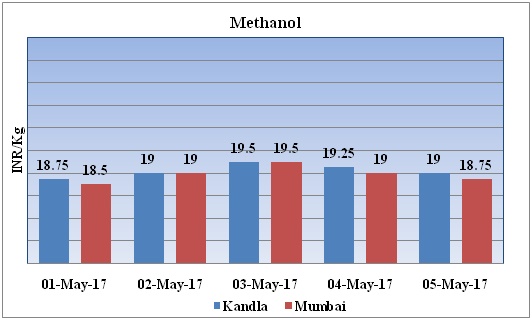

Weekly Price Trend: 01-05-2017 to 05-05-2017

- The above graph focuses on the Methanol price trend for the current week. Prices have followed volatile inclination for this week. By the end of the week prices were assessed around Rs.19/Kg for Kandla and Rs 18.75/kg Mumbai ports.

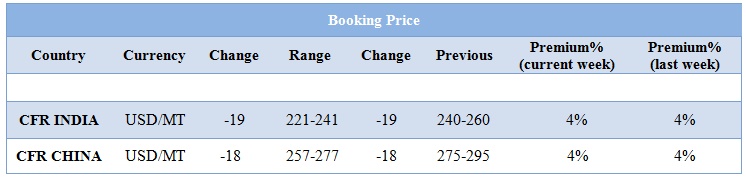

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed volatile inclination and by the end of the week prices were evaluated at Rs 19/kg for Kandla and Rs 18.75/kg for Mumbai ports.

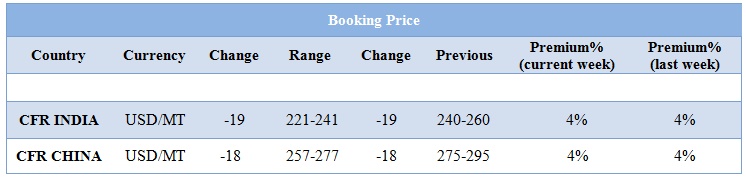

- CFR India prices were assessed in the range of USD 221-241/MTS. Prices have plunged USD 19/mt in compares to previous week.

- FOB Korea prices of methanol were evaluated around at the level of USD 314/mt.

- CFR China prices were assessed in the range of USD 257-277/MT prices have decreased in compares to previous week.

- This week methanol market have followed volatile trend but at the end of the week prices have plunged.

- Presently market is moving with soft –to-sluggish velocity.

- The leading manufacturer of Olefins from Methanol-to-olefins MTO) units are likely to resume their production by end of this month. This means that demand for methanol will shoot up in China.

- But unlikely there has been no aggression in demand as majority of the units has piled up their inventory earlier in the month of December.

- Prices remained soft-to-stable for this week in China. Units like Inner-Mongolia Erods Jinchengtai Chemical having the production capacity of 9,00,000 tonnes per year has resumed its production post maintenance on 15 April.

- The other unit Shandong Yunkuang Coking has also restarted the unit on 20 April having the production capacity of 2,00,000 mt/year.

- Buyers further believe softening in prices due to heavy supply of the chemical in the month of May. Similar trend are seen in other south Asian countries like Taiwan, South Korea and India.

- This week oil prices have followed little volatility and at the end of the week prices sharply have plunged. On Thursday oil prices crashed to five-month lows as concerns about global oversupply wiped out all of the price gains since OPEC's move to cut output.

- Analysts agreed the steep price falls would likely force OPEC members to extend production cuts later this month, but the prospect of deeper cuts appeared slim. OPEC is scheduled to meet on May 25 to decide whether to extend the cuts.

- On Thursday, closing crude values have decreased.WTI on NYME closed at $45.52/bbl, prices have decreased by $2.30/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $2.41/bbl in compared to last trading and was assessed around $48.38/bbl.

$1 = Rs. 64.37

Import Custom Ex. Rate USD/ INR: 65.10

Export Custom Ex. Rate USD/ INR: 63.40