Methanol Weekly Report 07 July 2018

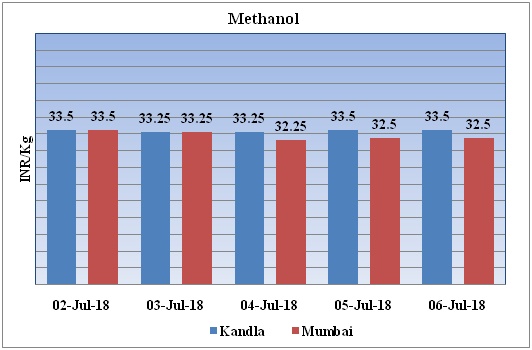

Weekly Price Trend: 02-07-2018 to 06-07-2018

The above graph focuses on the Methanol price trend for the current week. Prices have followed volatile trend for this week. By the end of the week prices were assessed around Rs 33.5/Kg for Kandla and Rs 32.5/kg Mumbai ports.

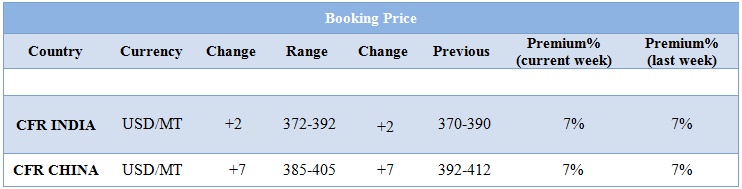

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed volatile trend and by the end of the week prices were evaluated at Rs 33.5/kg for Kandla and Rs 32.5/kg for Mumbai ports.

- CFR India prices were assessed in the range of USD 382/MTS. Prices have increased in compares to previous week.

- This week CFR India prices have increased as market is moving with uncertain velocity.

- Shaanxi Carbonification Energy shuts its methanol plant.

- China’s Shandong Rongxin restarts its methanol plant.

- China’s Yankuang Lunan shuts its methanol plant.

- In China in the month of April and May methanol prices were escalating on supply shortage due to heavy shutdown in domestic spring turnaround season.

- However, in June, methanol market remained lower by plant restarts combined with MTO plant turnarounds.

- As per market analysis, in the first half of 2018, China’s methanol market is ascertained by slower capacity growth, poor profits in downstream industries and heavy MTO plant turnarounds.

- In the second half of 2018, methanol availability is expected to remain low in China. In the last quarter, the production from gas based methanol plants is expected to be capped by feedstock restrictions.

- On the demand side, some traditional downstream derivative plants may come on line. In the meanwhile, demand for methanol in fuel application is likely to increase in winter.

- As a result, for second half of this year it is anticipated that methanol market will remain high end from the perspective of supply-demand situation.

- This week oil prices have followed volatile trend. On Thursday Oil fell after U.S. President Donald Trump demanded OPEC cut crude prices, but the market found some support from an Iranian threat to block shipments through the Strait of Hormuz.

- On Thursday, closing crude values have plunged. WTI on NYME closed at $72.94/bbl; prices have plunged by $1.20/bbl in compared to last closing prices. While Brent on Inter Continental Exchange plunged by $ 0.37/bbl in compare to last closing price and was assessed around $77.39/bbl.

$1 = Rs. 68.87

Import Custom Ex. Rate USD/ INR: 69.70

Export Custom Ex. Rate USD/ INR: 68.00