Methanol Weekly Report 10 March 2018

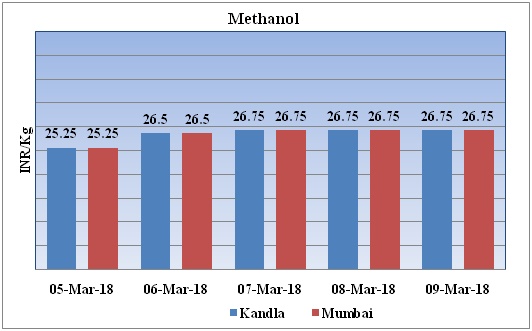

Weekly Price Trend: 05-03-2018 to 09-03-2018

The above graph focuses on the Methanol price trend for the current week. Prices have followed up trend for this week. By the end of the week prices were assessed around Rs 26.75/Kg for Kandla and Rs 26.75/kg Mumbai ports.

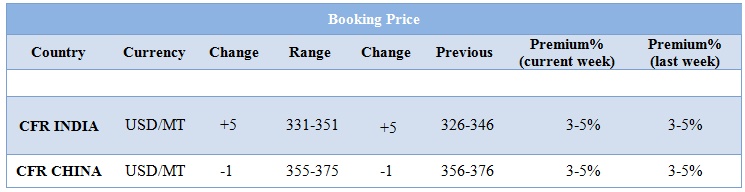

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed uptrend and by the end of the week prices were evaluated at Rs 26.75/kg for Kandla and Rs 26.75/kg for Mumbai ports.

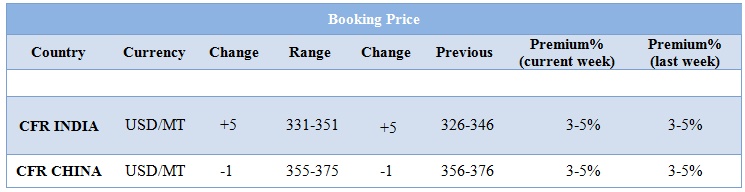

- CFR India prices were assessed in the range of USD 341/MTS. Prices have increased by USD 5/mt in compares to previous week.

- CFR China prices of methanol were evaluated at USD 365/mt.

- FOB Korea prices of Methanol were evaluated USD 385/mt.

- This week methanol prices have increased on low inventory level of approx 300,000 mt in China.

- Several domestic natural gas-fed methanol plants have restarted in China after Spring Festival holiday, as feedstock natural gas availability increases. As per report, around 2.5 million mt/yr capacity will be back on stream in March.

- Additionally, the spring turnaround season is expected to begin in Mar. Some plants with a combined capacity about 4.5 million mt/yr have announced maintenance plans.

- However, the restart of natural gas based plant will set off the plant turnaround.

- Methanol imports to China are expected to reduce around 300,000 tons due to overseas plant maintenance.

- So many plants are going for maintenance turnaround along with Sailboat Petrochemical Fund Ningbo which will reduce the demand fro methanol.

- As per the analysis market players have said that it is not confirmed that methanol market will go up continuously. It is anticipated that for short term methanol market will be positive.

- Iran’s Zagros is planning to shut its Methanol plant no. 2 in early April for 50 days for maintenance. Plant is based at Asaluyeh, Iran having the production capacity of 1.65 million mt/year.

- As per report, Iran’s Fanavaran is planning to shut its methanol plant in mid April for 20 days maintenance turnaround.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $60.12/bbl; prices have decreased by $1.03/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.73/bbl in compared to last trading and was assessed around $63.61/bbl.

- On Friday, crude oil futures rose as Asian stock markets gained on North Korean leader Kim Jong Un will meet with U.S. President Donald Trump.

- As per report, U.S. crude output is expected to surge beyond 11 million bpd by late 2018, limiting the effectiveness of output cuts by the Organization of the Petroleum Exporting Countries, Russia and other producers.

$1 = Rs. 65.16

Import Custom Ex. Rate USD/ INR: 66.10

Export Custom Ex. Rate USD/ INR: 64.40