Methanol Weekly Report 12 May 2018

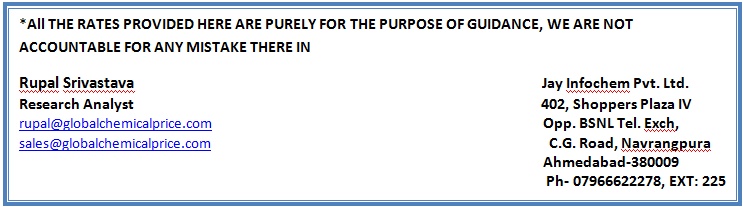

Weekly Price Trend: 07-05-2018 to 11-05-2018

The above graph focuses on the Methanol price trend for the current week. Prices have followed weak trend for this week. By the end of the week prices were assessed around Rs 32.5/Kg for Kandla and Rs 32.5/kg Mumbai ports.

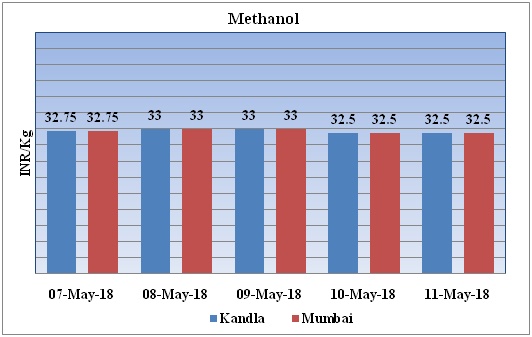

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed weak trend and by the end of the week prices were evaluated at Rs 32.5/kg for Kandla and Rs 32.5/kg for Mumbai ports.

- CFR India prices were assessed in the range of USD 389/MTS. Prices have decreased by USD 10/mt in compares to previous week.

- CFR China prices of methanol were evaluated at USD 412/mt.

- FOB Korea prices of Methanol were evaluated USD 413/mt.

- Market players have said that reintroduction of US sanctions against Iran could delay implementation of Iran's ambitious methanol projects on the back of technology and capital bans, and hinder the country's methanol exports amid banking and currency restrictions,

- This week domestic methanol prices have followed weak trend while CFR China prices have escalated.

- China’s methanol price has been increasing on firm fundamentals with bullish macroeconomic news since this March.

- Petronas and BMC restarted their methanol plants in Apr. SMC and FPC are going to restart their plants in near term. With these plants restarting, China’s methanol imports are likely to increase in June.

- China’s petrochemical imports from Iran are not expected to take a major hit upon the US’ re-imposition of sanctions against the Middle Eastern country. Even before the landmark 2015 Iran nuclear deal, the world's second-biggest economy has been procuring heavy volumes of methanol, as well as crude, from Iran.

- The government is contemplating a 'Methanol Economy Fund' to promote indigenously-produced methanol shihc could substitute 10 percent of India's crude oil imports by 2030, thereby reducing its fuel bill by around 30 percent, Road Transport and Highways Minister Nitin Gadkari.

- Making statement on methanol in Lok Sabha, Gadkari said the final roadmap for 'Methanol Economy' being worked out by NITI Aayog was targeting an annual reduction of $100 billion by 2030 in crude imports.

- This week with the little volatility oil prices have escalated sharply. On Thursday as traders adjusted to the prospects of renewed U.S. sanctions against major crude exporter Iran amid an already tightening market.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $69.06/bbl; prices have decreased by $1.67/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $1.32/bbl in compared to last trading and was assessed around $74.85/bbl.

- The United States plans to impose new sanctions against Iran, which produces around 4 percent of global oil supplies, after dump an agreement reached in late 2015 which limited Tehran's nuclear ambitions in exchange for removing U.S.-Europe sanctions.

$1 = Rs. 67.33

Import Custom Ex. Rate USD/ INR: 67.50

Export Custom Ex. Rate USD/ INR: 65.80